AI Boom Reshapes US Markets with Rising Financial Risks

The artificial intelligence build-out in the United States has shifted from an equity story to a funding story. Tech and infrastructure players are no longer relying only on cash and stock; they are issuing record volumes of investment grade bonds and leaning on debt to finance data centres, GPUs and cloud platforms. In parallel, an uptick in AI-driven M&A is increasing leverage and complexity across sectors. For now, markets are happy to finance the wave. The question for boards and policymakers is how much of this exposure is sustainable if AI returns undershoot the current narrative.

Key takeaways

-

AI capital expenditure is driving record US investment grade issuance, with tech-related bonds already at all-time highs and projected to account for a quarter of new supply in coming years.

-

Major asset managers and banks are warning that AI debt risks are “stacking” across credit markets, creating new channels for stress if adoption or profitability disappoint.

-

Enterprises and investors need a more disciplined approach to AI funding decisions, stress testing and scenario planning, rather than assuming that cheap credit and exponential demand will persist indefinitely.

How the AI boom is reshaping US credit markets

The AI race has become a capital-intensive infrastructure project. Hyperscalers and large tech firms are now borrowing at scale to fund data centres, fibre, power, and specialised chips, rather than relying solely on retained earnings.

Recent reporting shows that US and European tech groups including Amazon, Microsoft, Alphabet, Oracle and Meta have raised close to 100 billion dollars in bonds in just a few months, explicitly to finance AI and cloud expansion. Issuers are taking advantage of lower rates and strong demand for high-quality corporate paper.

At the same time, bank strategists expect AI-linked investment grade issuance to reach unprecedented levels in the next cycle. One large US bank projects that AI could push US investment grade bond sales to around 1.8 trillion dollars in 2026, with AI-related deals making up a substantial share.

Investment grade debt issuance at record levels

For fixed-income investors, the shift is visible in the numbers:

-

Public investment grade tech issuance in dollars and euros has already exceeded previous annual records, with roughly 186 billion dollars of deals year-to-date.

-

More than 45 percent of that supply has arrived in just the last two months, as AI-heavy issuers rushed to lock in funding.

-

Analysts at several firms estimate that AI-linked investment grade bonds alone could total 1.5 trillion dollars by 2030 if current trends persist.

Crucially, these are not distressed issuers. The large platforms still carry strong credit ratings, low net leverage and robust cash flows. That keeps spreads relatively tight and has encouraged investors to treat AI bonds as a high-quality way to gain exposure to growth.

The risk is subtler. As one major fixed-income manager put it, the sector is seeing risks “converge and stack” as the same macro theme — AI — drives equity valuations, capex decisions and bond supply at once.

For CIOs and CFOs on the corporate side, this has an important implication: AI investment is not just a technology strategy; it is changing the firm’s position in credit markets, refinancing cycles and macro-sensitivity.

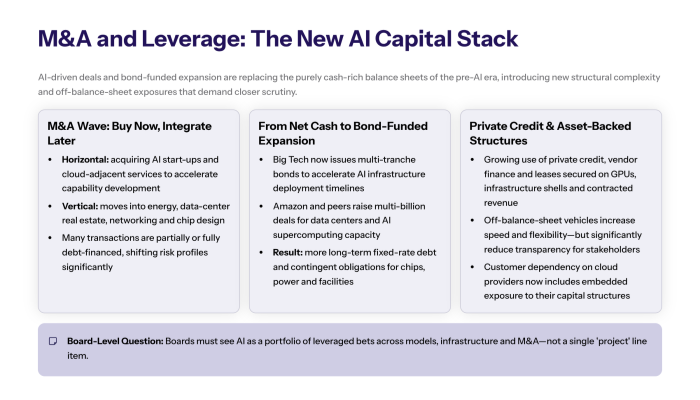

M&A, leverage and the new AI capital stack

Debt issuance is only one part of the AI funding picture. The other is a renewed wave of mergers, acquisitions and strategic stakes underpinned by the same narrative: secure AI capabilities now, integrate later.

Reports from market commentators describe a clear pattern. AI is driving both horizontal consolidation (buying AI start-ups and cloud-adjacent services) and vertical integration (energy, data-centre real estate, networking, chip design). Many of these deals are partially or fully debt-financed, often in investment grade form but occasionally through private credit structures.

From balance-sheet cash to bond-funded AI expansion

A few years ago, Big Tech’s most prominent feature was enormous net cash positions. Today, those same companies are comfortable issuing multi-tranche bonds to accelerate AI infrastructure:

-

Amazon has tapped the bond market with a multi-billion-dollar deal that drew several times that amount in orders, earmarked for data-centre expansion and AI supercomputing.

-

Alphabet, Meta and Oracle have collectively raised tens of billions through bond offerings tied to AI-driven capex and, in some cases, acquisitions or strategic partnerships.

The result is a capital stack that looks different from the pre-AI era: less reliance on internal cash, more long-term fixed-rate debt, and more contingent obligations tied to data-centre projects, chip supply contracts and power-purchase agreements.

For boards, this raises governance questions. AI is not a single project with an obvious payback profile. It is a series of overlapping bets in models, infrastructure, and product integration. Cognativ’s earlier analysis of tech’s trillion-dollar bet on AI emphasised that the investment window is both urgent and uncertain. Funding those bets with leverage magnifies outcomes in both directions.

Private credit and asset-backed AI financing

The bond market is only part of the story. Private credit, vendor finance and asset-backed structures are increasingly being used to finance GPUs, data-centre shells and energy infrastructure. Commentators note that many deals are structured as off-balance sheet vehicles or long-dated leases secured on physical assets and contracted revenue.

The advantage is speed and flexibility. The downside is opacity. When a significant portion of AI infrastructure is funded through non-public channels, it becomes harder for regulators and investors to understand aggregate leverage and counterparty exposure.

For enterprises that consume AI services rather than building infrastructure themselves, this matters indirectly. Dependencies on third-party clouds and platforms now carry an embedded exposure to their capital structure. That makes vendor risk assessments and contractual protections part of the AI strategy conversation.

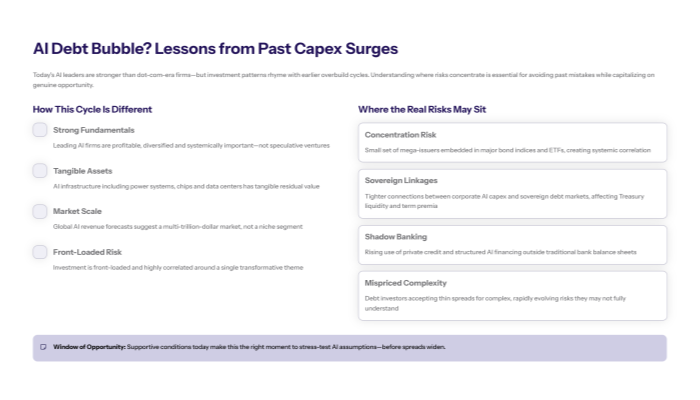

Are we building an AI-driven debt bubble

Comparisons with the dot-com era are inevitable. Markets remember previous capex booms in telecoms and shale energy, where debt-fuelled investment outpaced sustainable economics and led to painful write-downs or restructurings.

At the moment, most central banks and supervisors stop short of calling the current AI cycle a bubble. Instead, they warn that valuations and debt growth are “stretched” and that FOMO is clearly present in both equity and credit markets.

Comparisons with past capex cycles

There are important differences from earlier episodes:

-

Today’s leading AI firms are profitable, diversified and systemically important in ways early dot-com companies were not.

-

AI infrastructure — power, chips, data-centres — has tangible residual value, even if specific applications fail.

-

Global AI revenue projections into the next decade suggest a multi-trillion-dollar addressable market, not a niche.

Yet the risk patterns rhyme with history:

-

Investment is front-loaded and highly correlated around a single theme.

-

Capex decisions are being justified using aggressive adoption and pricing assumptions.

-

Debt investors are accepting relatively thin spreads for complex and evolving risks.

In that context, the more relevant question is not whether the AI boom is “a bubble” in binary terms, but where the pain would concentrate if expectations were revised sharply downward.

Where the real systemic risks may sit

Several actors have highlighted specific risk channels:

-

Concentration in a small number of large issuers, meaning that credit stress in one or two names could reverberate across passive bond indices and ETFs.

-

Growing links between corporate AI capex and sovereign debt markets, since large issuance waves can influence Treasury liquidity and term premia. Cognativ has analysed this dynamic in detail in its note on

corporate AI capex and US Treasuries

.

-

The use of private credit and structured finance for AI projects, which may transmit stress outside traditional bank balance sheets and into less transparent corners of the system.

For now, supportive macro conditions — moderating rates, solid earnings and liquid markets — are cushioning these risks. That makes this the right moment, not a future crisis, for organisations and regulators to interrogate assumptions.

What this means for enterprises, CFOs and boards

For corporate leaders, the AI funding wave is not just a macro story. It directly affects capital structure choices, cost of capital, and the risk profile of strategic plans.

Rethinking AI investment under tighter financial discipline

A common early-stage stance has been that “everyone must spend on AI” to stay competitive. That statement may be directionally true, but it is not sufficient for capital allocation. Boards should insist on AI investment frameworks that:

-

distinguish between core, adjacent and speculative AI projects

-

quantify expected financial and non-financial returns under multiple scenarios

-

factor in the cost and flexibility of funding sources (cash, equity, bonds, private credit)

-

build in stop-loss mechanisms or review points, rather than treating AI capex as irreversible

Enterprises that lack internal experience in structuring and evaluating these programmes can turn to partners with combined technology and financial expertise. Cognativ’s business strategy services and broader AI services offering are designed to connect model choices, infrastructure and governance with balance-sheet reality.

Implications for financial institutions and investors

Banks, insurers and asset managers face a dual exposure:

-

direct holdings of AI-linked corporate bonds and loans

-

indirect exposure through indices, ETFs and structured products tied to tech and credit markets

Risk teams should stress-test portfolios against scenarios where AI adoption is slower than forecast, pricing power erodes, or regulation increases capital costs. That includes looking beyond headline ratings to understand:

-

issuer-level reliance on AI-related revenue

-

concentration in specific names or sectors within credit portfolios

-

liquidity resilience in case of spread widening or ETF outflows

For institutions that finance AI infrastructure directly, there is also an operational dimension. Understanding AI workloads, utilisation patterns and obsolescence risk is becoming as important as traditional project finance metrics. Cognativ’s work on best practices for AI infrastructure and AI infrastructure solutions is relevant here, because credit analysis increasingly needs a technical lens.

Strategic playbook for enterprises in the AI debt era

The AI debt wave is not inherently negative. Long-term, fixed-rate funding of productive infrastructure can be a rational response to a transformative technology shift. The challenge is execution quality and risk management.

A practical playbook for executive teams might include:

-

Align AI roadmap with capital strategy

Treat AI initiatives as part of the corporate plan, not a side-project. Match funding tenor to asset life, and avoid stacking short-term funding on long-term bets.

-

Build optionality into infrastructure choices

Favour architectures that allow workload portability and modular upgrades over monolithic commitments. This can reduce the risk of being locked into stranded assets if economics or regulation change.

-

Strengthen governance and observability

Ensure that AI initiatives are subject to the same (or higher) standards of project governance, risk review and post-investment evaluation as other major capex decisions.

-

Consider partnership models

Not every enterprise needs to own full-stack AI infrastructure. Strategic use of cloud, managed services or joint ventures can reduce balance-sheet intensity while still delivering capability, especially for sectors such as banking and fintech or manufacturing where domain expertise is as critical as raw compute.

Conclusion

The AI boom is no longer just an innovation story; it is a funding story that is reshaping US credit markets and corporate balance sheets. Investment grade issuance linked to AI and cloud is at record highs, private credit is becoming more involved, and M&A strategies are being built around securing data-centre capacity, models and talent. All of this is happening in a macro environment that is still benign, but increasingly sensitive to concentrated themes.

For enterprises and investors, the message is not to retreat from AI, but to raise the quality of decision-making around how it is financed, governed and scaled. Those who combine technical insight with disciplined capital allocation will be best placed to benefit if the AI thesis plays out — and most resilient if it evolves more slowly than today’s headlines suggest.

If your organisation is reassessing its AI roadmap, capital structure or vendor strategy in light of these dynamics, explore how Cognativ’s AI-first architecture and AI services can help align technology, infrastructure and balance-sheet choices.

Stay ahead of AI market shifts, infrastructure trends and policy developments. Follow What Goes On , Cognativ’s weekly tech digest, via the Cognativ AI and software insights blog for continuous, executive-level analysis.