AI in Private Equity: Best Strategies for Enhanced Investment Insights

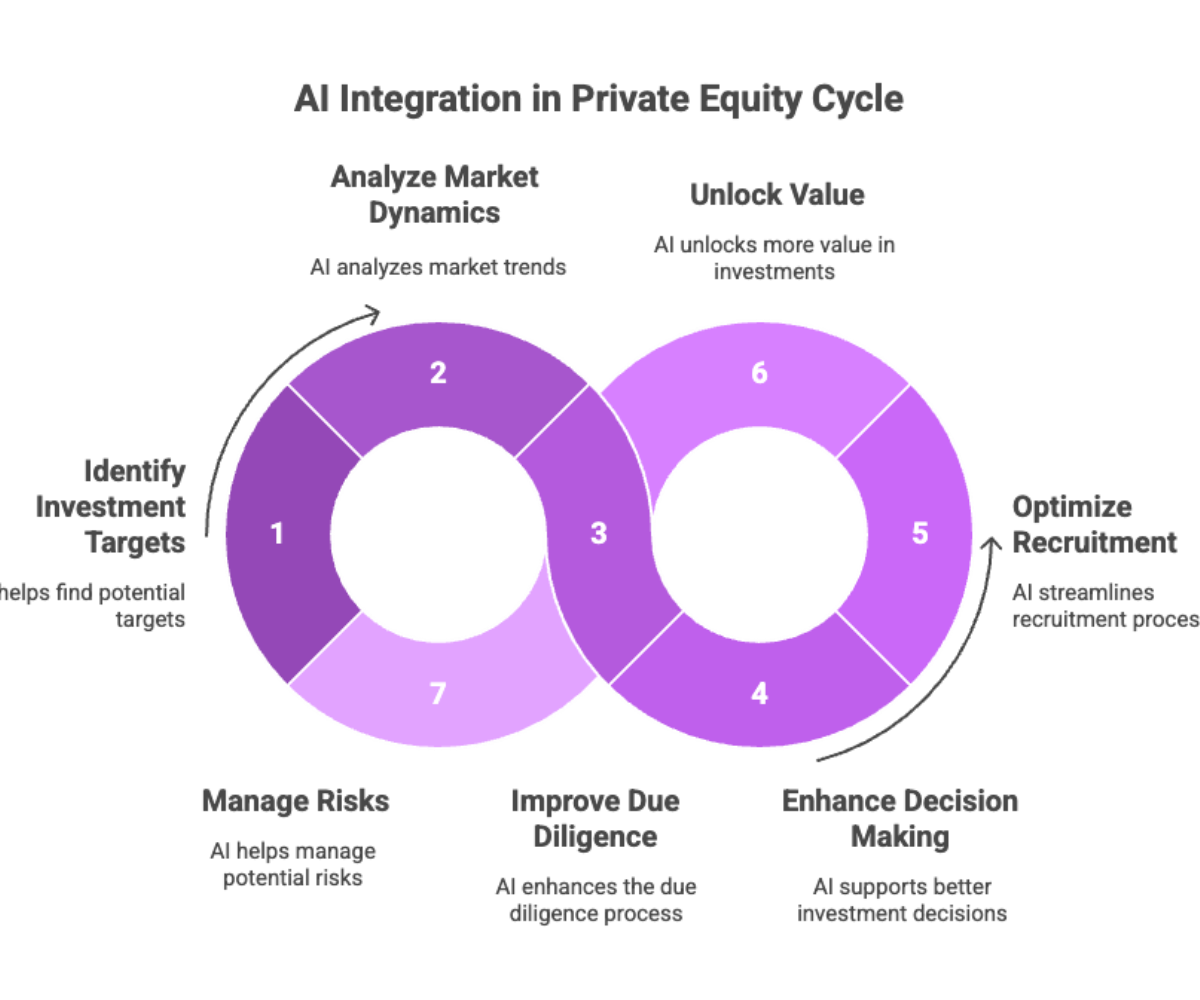

In today's rapidly evolving financial landscape, AI in private equity is revolutionizing how pe firms identify potential investment targets and analyze market dynamics. By using AI and cutting edge technologies, firms gain a competitive edge through improved due diligence process, enhanced decision making, and optimized recruitment processes. This integration allows firms to make better investment decisions throughout the investment lifecycle, unlocking more value while managing potential risks in complex market conditions.

Key Takeaways

-

AI enhances informed investment decisions by efficiently identifying patterns in large volumes of complex data, enabling private equity firms to uncover hidden opportunities.

-

Integrating AI with existing CRM systems and other new technologies streamlines workflows, improving collaboration and accelerating deal evaluation.

-

Leveraging AI-driven solutions empowers firms to adapt their business model to evolving market demands, driving sustained growth and competitive positioning.

Introduction to Private Equity and Artificial Intelligence

The private equity industry is undergoing a significant transformation, driven by the rapid evolution of artificial intelligence (AI). As private equity firms seek to stay competitive in a complex and data-intensive environment, many are turning to AI tools—including generative AI—to uncover patterns, enhance due diligence, and inform investment decisions with unprecedented precision.

Unlike traditional investment models, AI empowers firms to analyze vast amounts of historical data, streamline operations, and optimize the performance of their portfolio companies. With growing interest across the sector, AI in private equity is no longer a futuristic concept—it's a current-day differentiator shaping how deals are sourced, vetted, and managed.

The Role of AI in Investment Firms

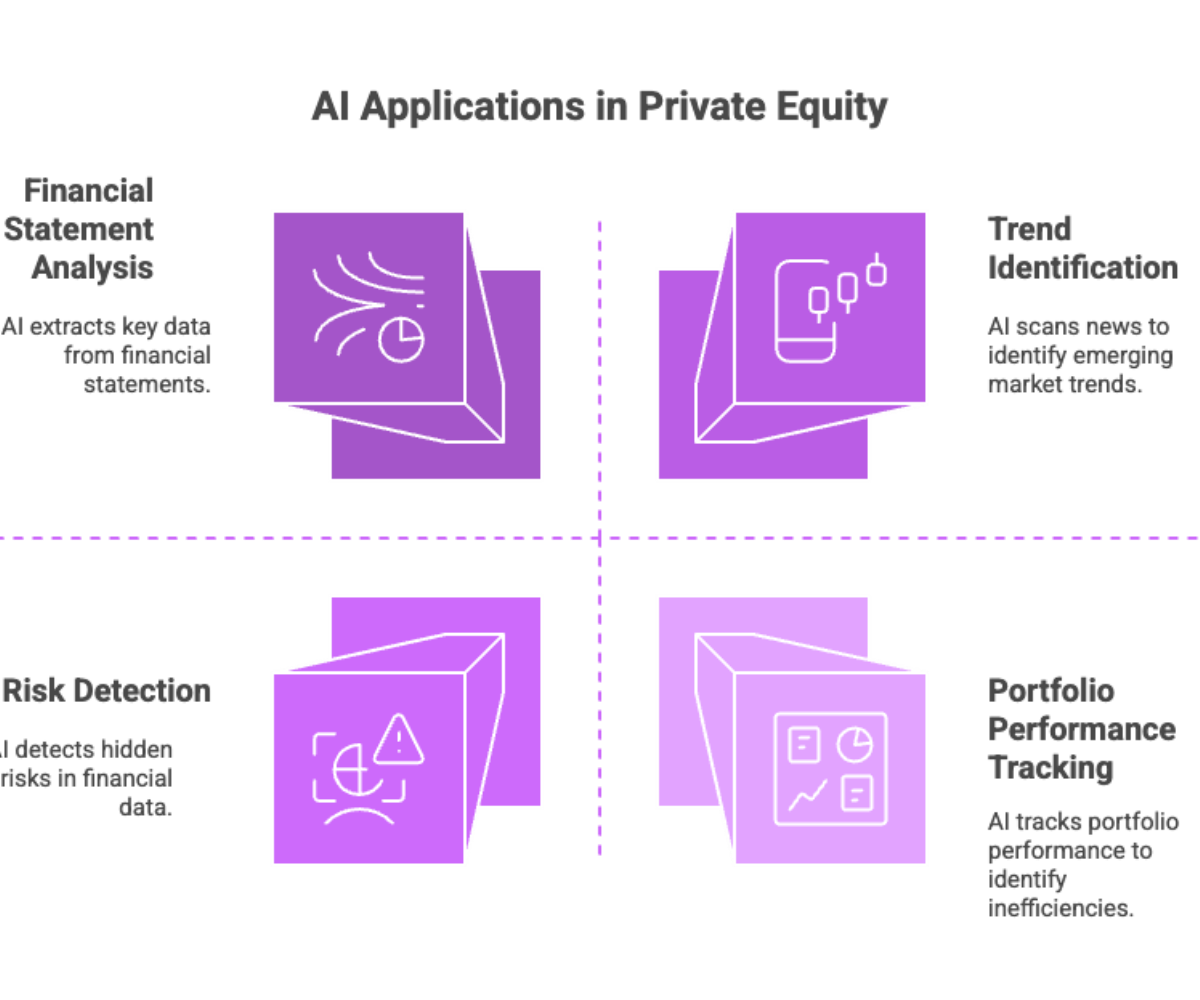

AI’s adoption in investment firms, particularly within private equity, is changing the game. It enables fund managers to move beyond intuition and gut-feeling, providing strategic insights backed by data.

Core applications of AI in private equity:

-

Automated financial analysis: AI parses financial statements to extract key data points, identify inconsistencies, and flag anomalies.

-

Risk profiling: AI systems detect hidden risks by comparing current data with historical market patterns.

-

Market intelligence: Tools can scan news, social feeds, and regulatory filings to uncover trends relevant to target companies.

-

Operational enhancements: AI can track portfolio performance, identify areas of inefficiency, and suggest improvements.

By applying machine learning algorithms across multiple data sources, AI equips investment professionals with deeper, real-time insight—driving smarter, faster, and more accurate decisions.

Generative AI in Private Markets

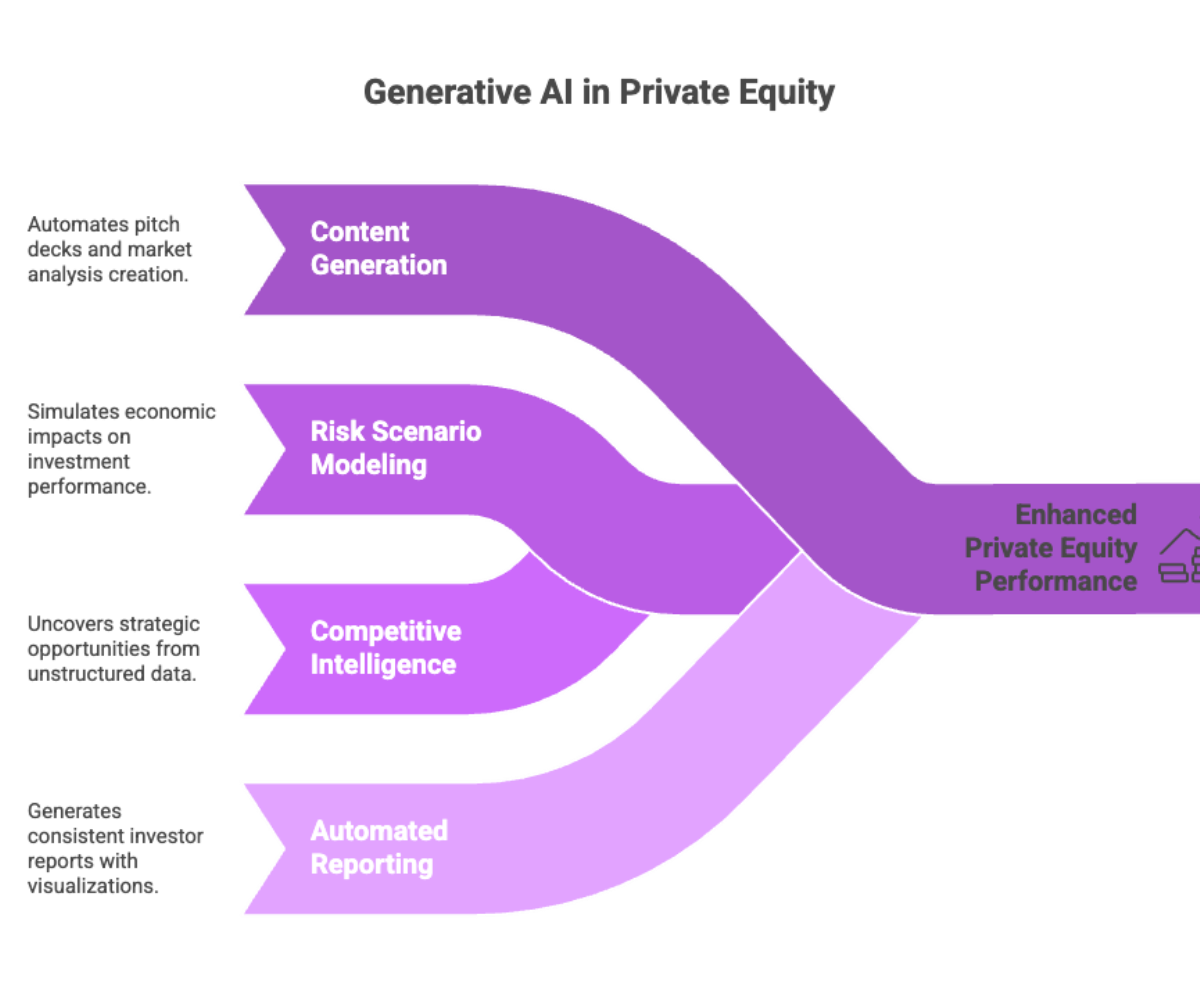

Generative AI is playing a growing role in private AI for private markets, especially in deal origination and risk analysis. Using natural language processing (NLP), generative models summarize documents, generate investment memos, and even model potential exit scenarios.

Benefits of generative AI in private equity:

-

Content generation: Automatically drafts pitch decks, due diligence summaries, and market analyses.

-

Risk scenario modeling: Simulates the impact of economic changes, market trends, or business events on investment performance.

-

Competitive intelligence: Generates insights from unstructured data (emails, news, earnings calls) to uncover strategic opportunities.

-

Automated reporting: Creates investor reports with consistent language and visualizations.

Private equity firms leveraging generative AI tools report significant improvements in operational efficiency, reduction in manual effort, and better clarity in risk management strategies.

Implementing AI in Private Equity Firms

While the potential is vast, effective AI implementation in private equity requires a carefully considered strategy. The right blend of technology, talent, and governance is essential to maximize returns on AI investments.

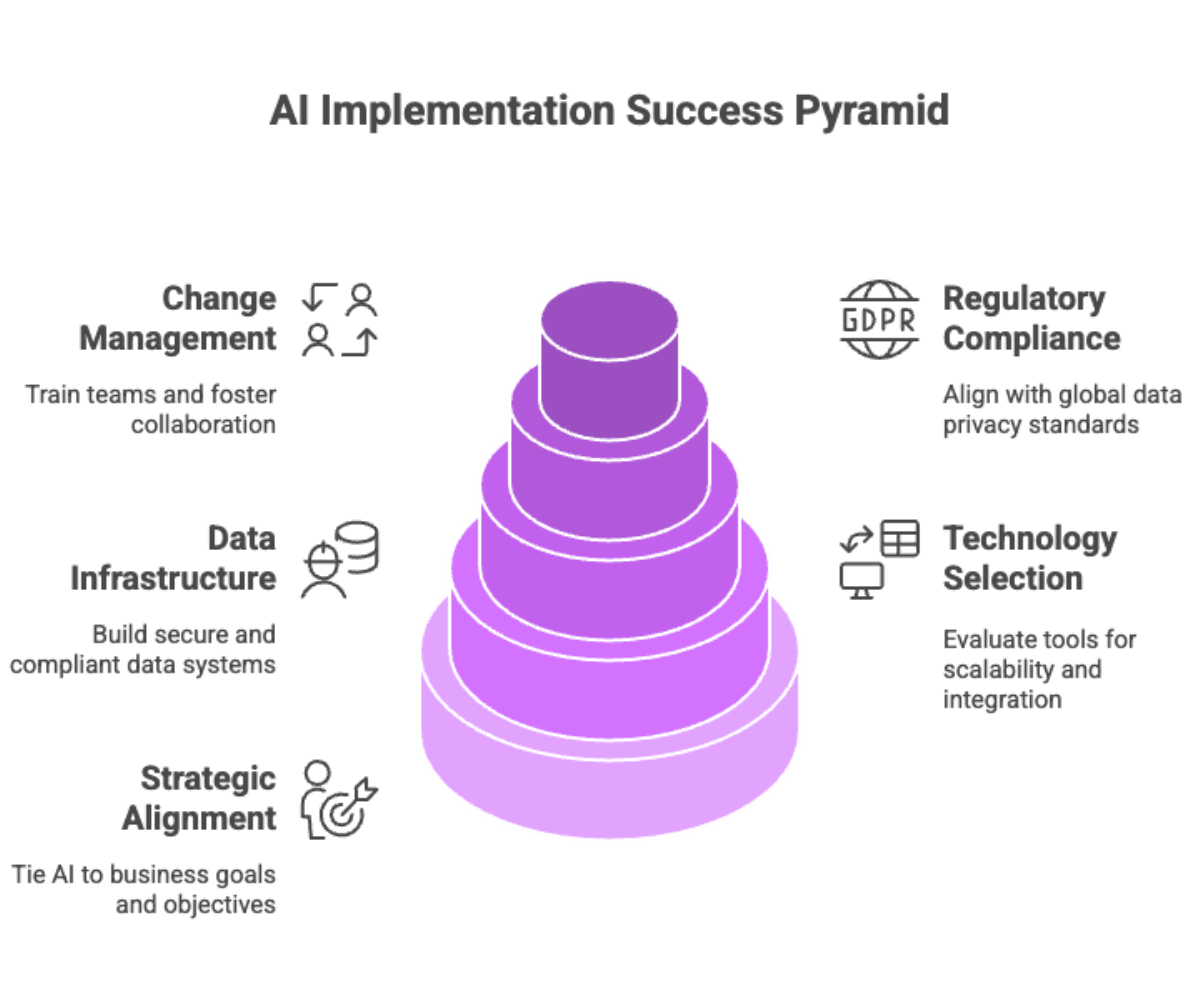

Key components of successful AI adoption:

-

Strategic alignment: Tie AI initiatives directly to business goals and firm-level objectives.

-

Technology selection: Evaluate tools for capabilities like scalability, integration with legacy systems, and customization.

-

Data infrastructure: Build secure and compliant systems that ensure access to clean, structured, and ethically sourced data.

-

Regulatory compliance: Align AI systems with global standards on data privacy, such as GDPR and CCPA.

-

Change management: Train internal teams, foster cross-functional collaboration, and mitigate resistance.

Firms that treat AI not just as a tool—but as a cultural shift—position themselves to lead in the new era of data-driven investing.

Due Diligence Reinvented with AI

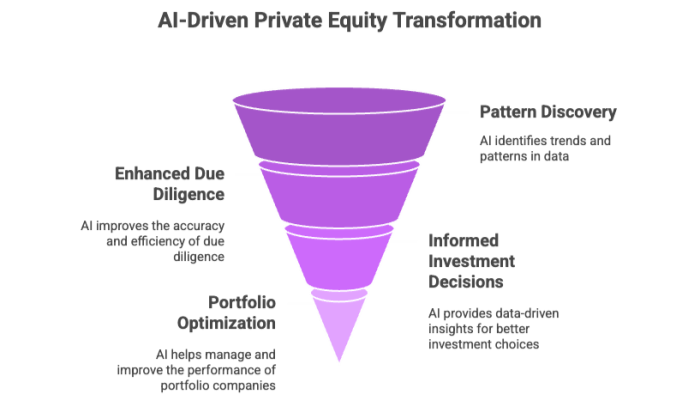

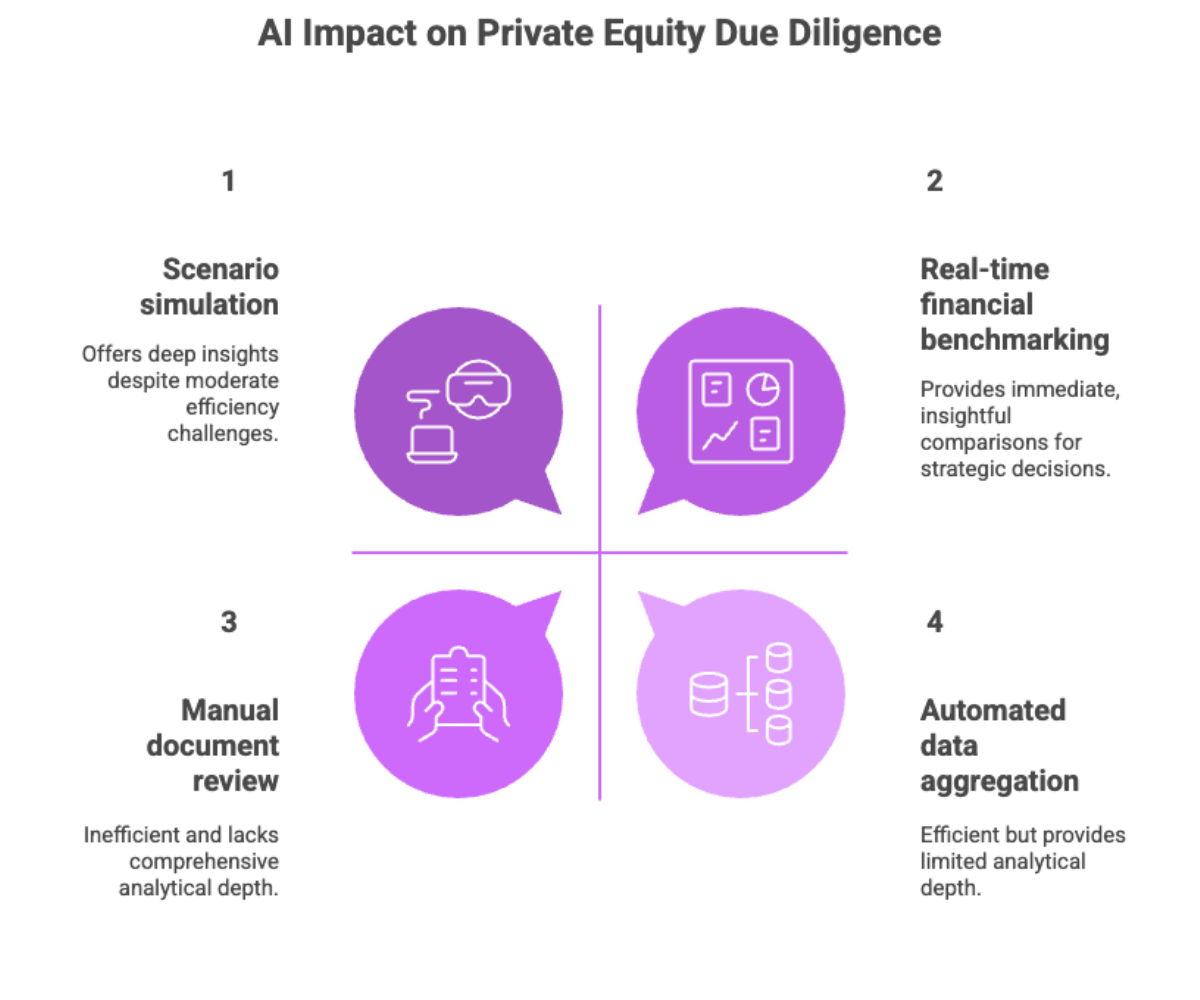

Perhaps the most impactful use case of AI in private equity lies in due diligence. Traditionally labor-intensive and time-consuming, due diligence can now be accelerated with AI’s analytical prowess.

How AI enhances the diligence process:

-

Data aggregation: Pulls and standardizes data from multiple sources—legal, financial, operational.

-

Document analysis: Uses NLP to scan contracts, agreements, and filings for red flags or key terms.

-

Financial benchmarking: Compares company performance against industry peers in real time.

-

Scenario simulation: Tests how various internal or external factors may affect the target company.

AI significantly reduces manual effort, enhances accuracy, and provides deeper valuable insights—all of which lead to better-informed investments and lower risk exposure.

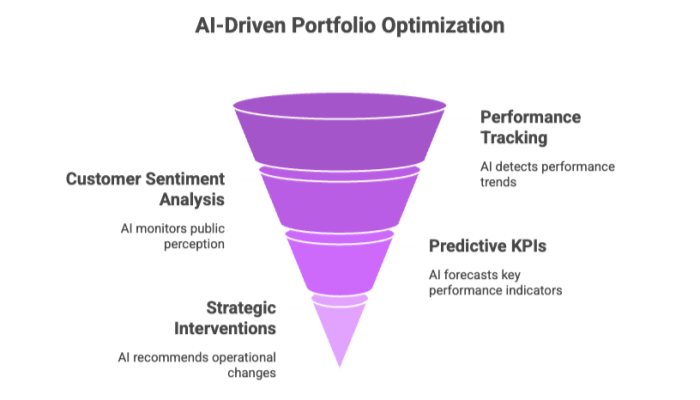

AI in Portfolio Monitoring and Optimization

Beyond deal-making, AI plays a crucial role in ongoing portfolio monitoring. With advanced analytics, firms can assess and improve the performance of their investments continuously.

Ongoing optimization with AI:

-

Performance tracking: AI detects early signs of underperformance or growth potential.

-

Customer sentiment analysis: Monitors public perception of portfolio companies through review data and social media.

-

Predictive KPIs: Uses data models to forecast sales, cash flow, and retention.

-

Strategic interventions: Recommends operational changes or additional funding based on real-time metrics.

By enabling proactive management, AI helps firms increase portfolio value, mitigate risks, and better time exits.

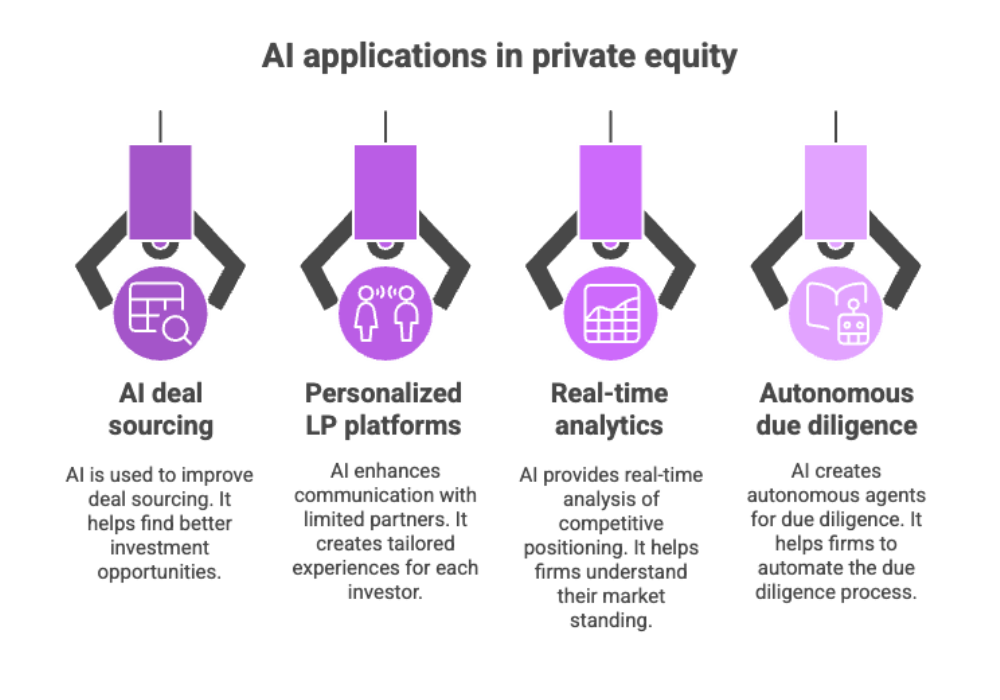

Future of AI in Private Equity

As AI technologies become more advanced and accessible, their integration into the private equity industry is expected to accelerate. We’re likely to see:

-

Hyper-personalized LP communication platforms

-

Real-time competitive positioning analytics

-

Autonomous due diligence agents

Moreover, AI may become instrumental in ESG scoring, climate risk modeling, and other areas where data-driven insight is critical.

Final Thoughts

The use of AI in private equity is reshaping how investment firms operate, analyze, and make decisions. From generative AI applications to automated due diligence, AI offers not just efficiency, but strategic advantage.

Firms that embrace AI tools and integrate them into their workflows will gain deeper insight, faster turnaround, and higher confidence in their investment decisions.

The key lies in combining AI's technological prowess with the domain expertise of seasoned investors—a partnership where machines augment judgment, not replace it.