Financial Software Development: Building Successful Fintech Solutions

Businesses that seek to enhance operational efficiency, deliver secure transactions, and streamline user experience increasingly rely on financial software development. Whether for payments, investments, budgeting, or compliance‐heavy operations, custom fintech solutions empower companies to automate tasks, derive real‐time insights, and propel revenue growth. But navigating the complexities—security, compliance, scalability—demands careful planning and the right development partner.

In this article, we’ll demystify financial software development and outline top trends, challenges, cost considerations, and best practices to help you strategize a custom financial solution that stands out in a competitive fintech landscape.

Table of Contents

- What Is Financial Software Development?

- Why Invest in Custom Financial Solutions?

- Top Trends in Financial Software Development

- Key Challenges and Mitigation Strategies

- Main Features of Effective Fintech Applications

- Choosing the Right Tech Stack

- 6 Stages of Financial Software Development

- Picking a Financial Software Development Company

- Cost Estimates and ROI

- Frequently Asked Questions

- Conclusion

What Is Financial Software Development?

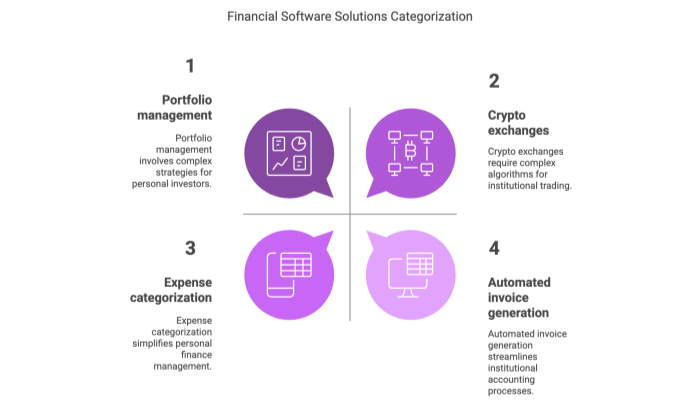

Financial software development involves designing custom or modified solutions for banking, trading, insurance, accounting, payments, and more. The goal is to simplify daily operations—like real‐time data tracking, automated transaction processing, and regulatory compliance—while supporting high‐volume, secure transactions. Solutions typically address these core areas:

- Payment and Money Transfer: Peer-to-peer apps, digital wallets, or remittance platforms.

- Investment & Trading: Stock trading, robo-advisory, portfolio management, or crypto exchanges.

- Budgeting & Saving: Personal finance managers with expense categorization, recurring bills, and micro‐saving tools.

- Lending & Borrowing: Credit scoring engines, loan lifecycle automation, or peer-to-peer (P2P) lending.

- Accounting & Bookkeeping: Automated invoice generation, expense reconciliation, and taxation modules.

Given the sensitive nature of financial data, these applications demand robust encryption, strict access controls, and comprehensive auditing systems to satisfy regulatory requirements.

Why Invest in Custom Financial Solutions?

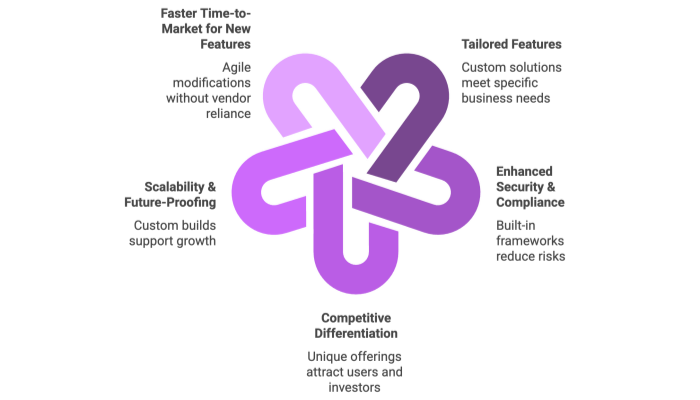

Custom financial solutions enable businesses to address unique workflows and specialized data analytics that generic platforms cannot offer. Investing in bespoke fintech development means that you only build the features your business needs—eliminating redundant modules and ensuring an optimized user experience.

Additional benefits include:

- Enhanced Security & Compliance: Specialized developers integrate compliance frameworks such as PCI DSS for payments, AML for banking, or GDPR for data protection, reducing risks and avoiding costly fines.

- Competitive Differentiation: Bespoke fintech applications can offer unique functionalities, whether it's a novel lending model or advanced trading analytics, helping your business stand out in a crowded market.

- Scalability & Future-Proofing: Custom builds often incorporate microservices or containerized architectures, allowing your solution to scale smoothly as your user base and transaction volumes grow.

- Faster Time-to-Market for New Features: When the solution is built to your specifications, you can implement real-time modifications—such as integrating BNPL (Buy Now Pay Later) or advanced AI predictions—without waiting for a vendor’s roadmap.

These advantages ensure that a custom financial software solution not only meets current operational needs but is also capable of evolving as your business grows.

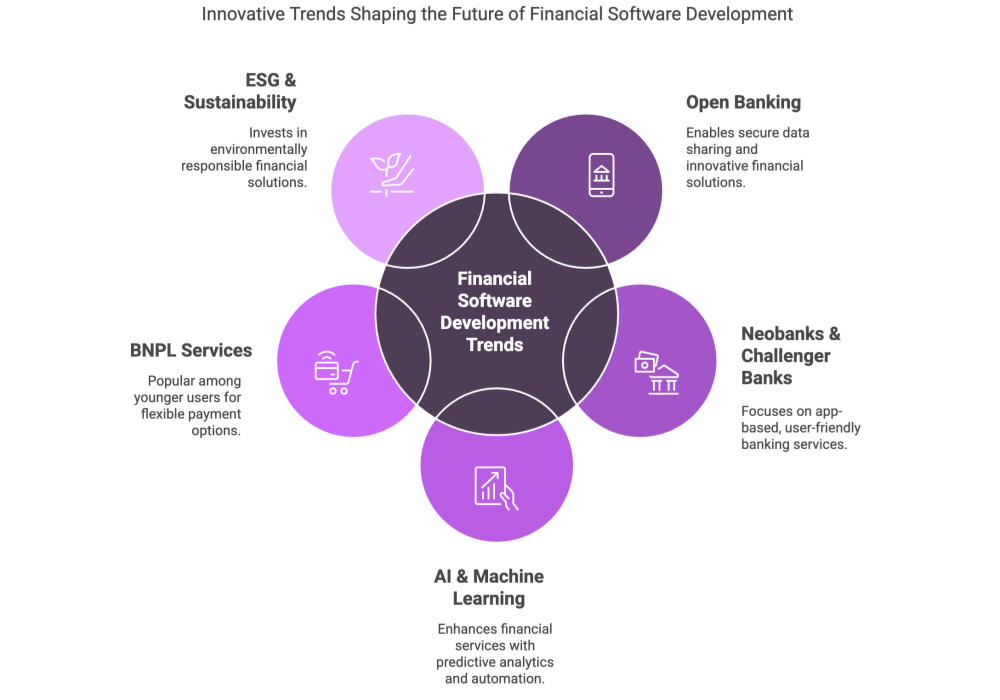

Top Trends in Financial Software Development

Innovation in the financial sector is rapid, and several trends are currently shaping the development of fintech solutions:

- Open Banking: APIs enable secure data sharing among banks and third-party providers, paving the way for personal finance dashboards and cross-bank payment portals.

- Neobanks & Challenger Banks: Digital banks are emerging with zero-fee accounts, microloans, and instant money transfers, relying on agile architectures and intuitive user interfaces.

- AI & Machine Learning: Predictive analytics enhance fraud detection, while robo-advisors, chatbots, and risk scoring systems improve customer engagement and operational efficiency.

- BNPL Services: Buy Now Pay Later solutions are gaining traction among younger audiences, requiring flexible payment processing and robust credit checks.

- ESG & Sustainability: Fintech solutions that focus on green finance track carbon footprints and invest in sustainable assets, appealing to eco-conscious consumers and investors.

These trends drive the development of more efficient, user-friendly, and secure financial applications, keeping companies competitive in a dynamic market.

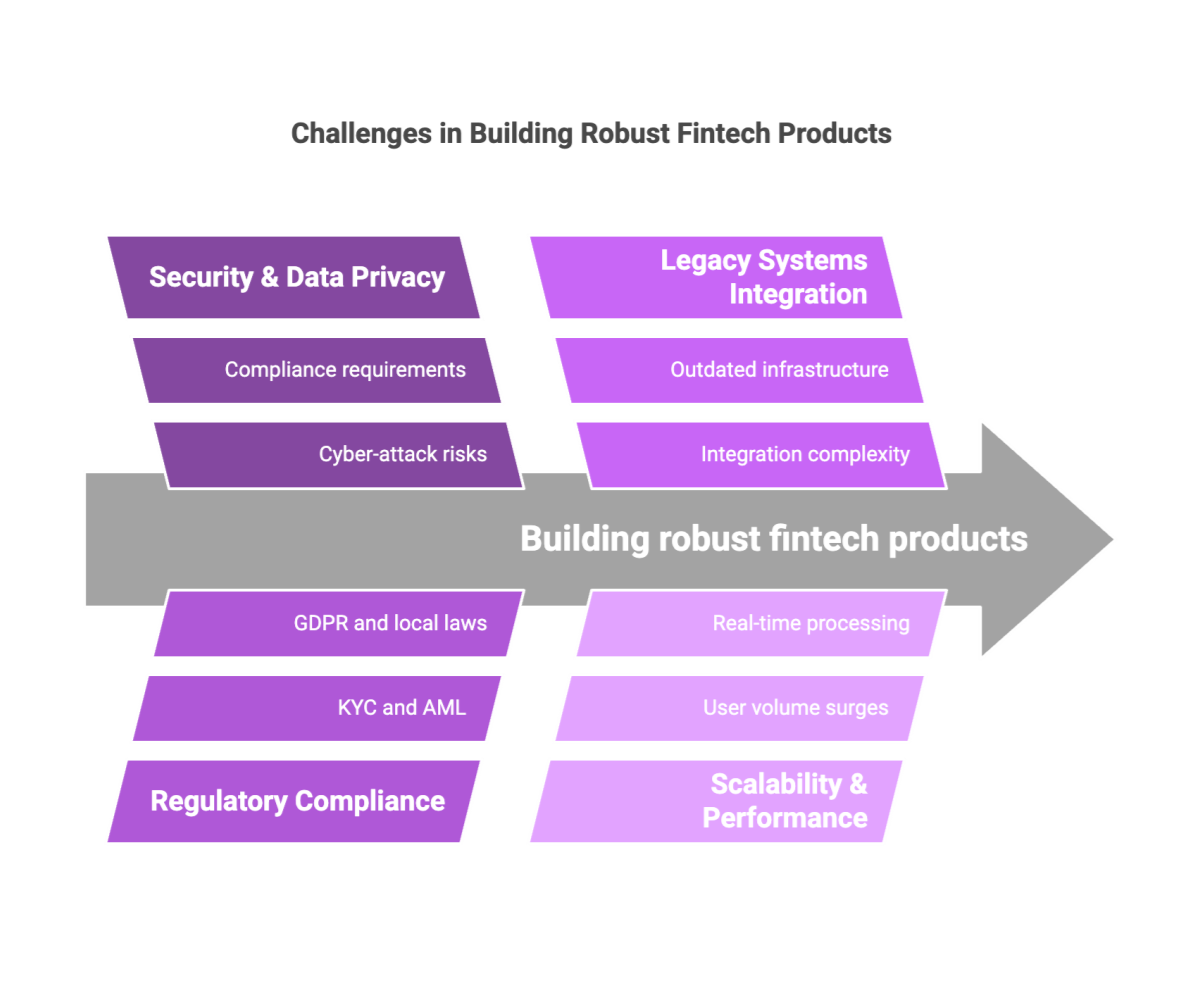

Key Challenges and Mitigation Strategies

Developing robust fintech products presents a number of challenges that must be strategically addressed:

- Security & Data Privacy: Financial applications are prime targets for cyber-attacks. To mitigate risks, implement multi-factor authentication, role-based permissions, and conduct regular penetration tests. Compliance with standards such as SOC2 and PCI DSS is also essential.

- Regulatory Compliance: Navigating regulations like KYC, AML, and GDPR can be complex. Collaborating with legal experts and building compliance modules to handle user verifications, reporting, and data anonymization is crucial.

- Legacy Systems Integration: Many financial institutions operate on decades-old infrastructure. Using well-documented APIs, microservices, or middleware solutions can help modernize these systems step-by-step while minimizing disruption.

- Scalability & Performance: High transaction volumes and real-time processing require scalable architectures. Solutions such as containerized microservices, load balancing, and cloud deployments (AWS, Azure, GCP) help achieve on-demand scalability.

- UX & Accessibility: Financial data can be complex. Ensuring the interface is user-friendly through thorough usability testing, minimalist design, and mobile responsiveness is critical for broad user adoption.

Addressing these challenges requires a careful balance of technical rigor, legal compliance, and user-centered design, ensuring that the final product is both robust and adaptable.

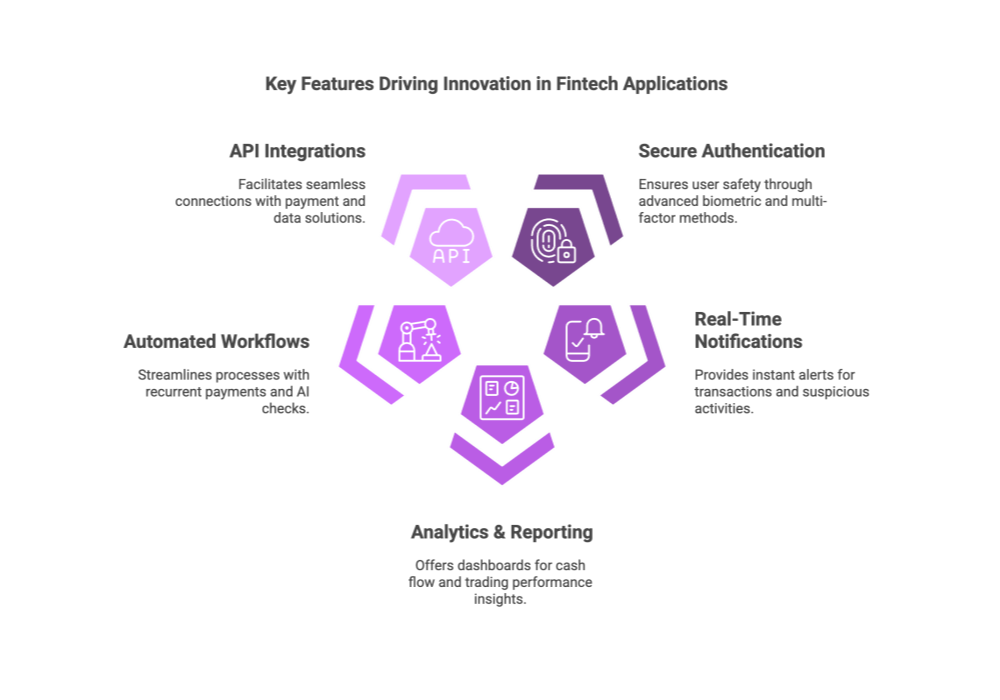

Main Features of Effective Fintech Applications

Effective fintech applications are built with a range of core features that ensure security, usability, and operational efficiency:

- Secure Authentication: Employ biometric logins, multi-factor authentication, and cryptographic keys to protect user data.

- Real-Time Notifications: Provide instant alerts for transactions, price fluctuations, or suspicious activities to keep users informed.

- Analytics & Reporting: Use dashboards to summarize cash flows, compliance metrics, and trading performance, enabling data-driven decision-making.

- Automated Workflows: Automate recurring tasks such as payments, invoice scheduling, and credit checks to reduce manual effort and errors.

- API Integrations: Seamlessly connect with payment gateways (Stripe, PayPal), eKYC solutions, and third-party data feeds to enhance functionality.

- Personalized Interfaces: Create user-centric designs with advanced filtering, targeted upselling, and multi-language support for a tailored experience.

These features form the backbone of a successful fintech solution, ensuring that users receive a secure, efficient, and intuitive experience.

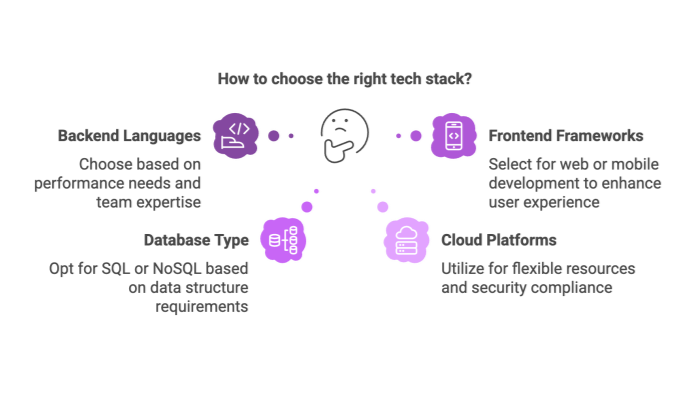

Choosing the Right Tech Stack

Selecting the appropriate technology stack is crucial for building robust financial software. For the backend, languages such as Node.js, Python, Java, .NET, or Go can be chosen based on performance requirements and team expertise. Frontend development is typically handled by frameworks like React.js, Angular, or Vue.js for web applications, while mobile solutions may be developed using Swift, Kotlin, or React Native.

Database choices range from SQL options like PostgreSQL and MySQL to NoSQL solutions such as MongoDB or Cassandra, depending on the data structure needs. Additionally, integrating cloud platforms like AWS, GCP, or Azure provides the scalability and advanced security required for fintech applications. Continuous integration and delivery (CI/CD) tools such as Jenkins, GitLab CI, or GitHub Actions help automate the development pipeline.

Pro Tip: Align your tech stack with compliance requirements; for example, both Azure and AWS offer frameworks that expedite HIPAA or PCI certification processes.

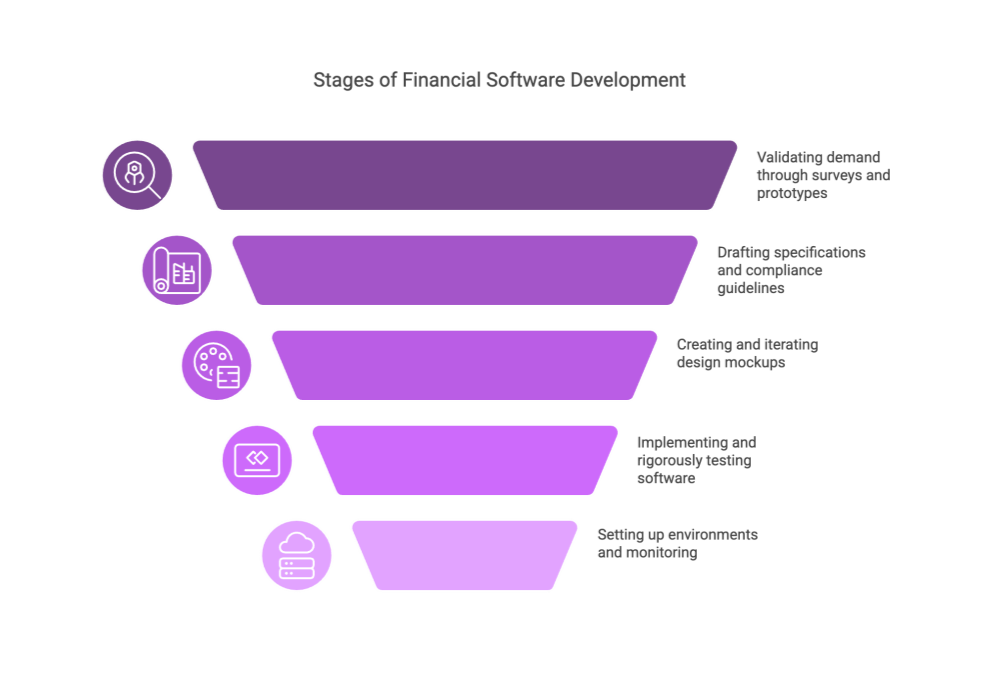

6 Stages of Financial Software Development

The development of a financial software solution typically progresses through six key stages:

1) Idea Generation & Validation

Identify market gaps, user pain points, or innovative concepts such as AI-based portfolio management. Validate demand using surveys, competitor analysis, and MVP prototypes to ensure there is a viable market need.

2) Planning & Requirements

Draft detailed functional specifications that outline transaction capacities, KYC flows, compliance guidelines, and user stories. This stage sets clear expectations and acceptance criteria for the project.

3) UI/UX & Prototyping

Create wireframes that map out user journeys and high-fidelity mockups to visualize the final product. Iterative prototyping allows for rapid feedback and refinement, ensuring the design is both functional and user-friendly.

4) Development & Testing

Implement the solution in iterative sprints, integrating essential security measures from the outset. Rigorous quality assurance processes, including unit, integration, and user acceptance tests, are conducted to verify each component's functionality.

5) Deployment & Maintenance

Set up staging and production environments in the cloud and deploy the solution. Continuous monitoring and timely patching are essential to maintain system performance and security.

6) Ongoing Updates

Evolve the product by adding new features, such as BNPL or AI modules, and refining existing functionalities to stay competitive in a dynamic market.

Picking a Financial Software Development Company

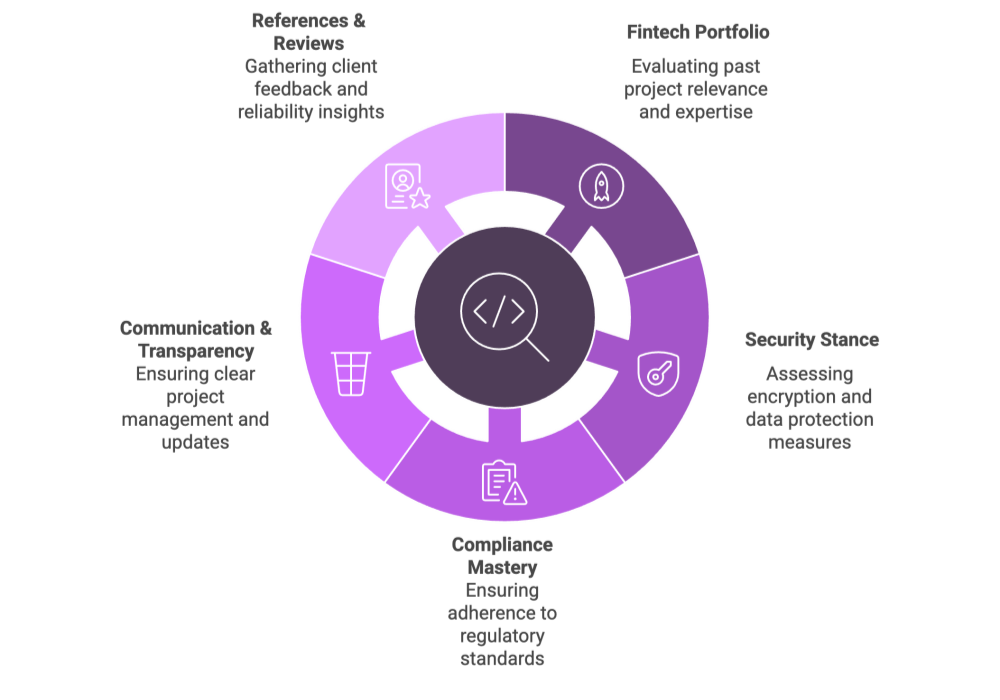

Choosing the right development partner is critical to the success of your fintech project. When evaluating potential companies, consider the following factors:

- Fintech Portfolio: Review the vendor’s experience with projects in banking, payments, crypto, or other financial services.

- Security Stance: Ensure they have a strong track record with encryption, regular audits, and robust data protection measures.

- Compliance Mastery: Verify their expertise in navigating regulatory requirements such as AML, KYC, and GDPR.

- Communication & Transparency: Look for clear timelines, dedicated project management, and agile communication practices.

- References & Reviews: Seek out client testimonials and case studies to assess reliability and performance.

A trusted partner will not only build a secure, scalable solution but also provide ongoing support to help you adapt to market changes.

Cost Estimates and ROI

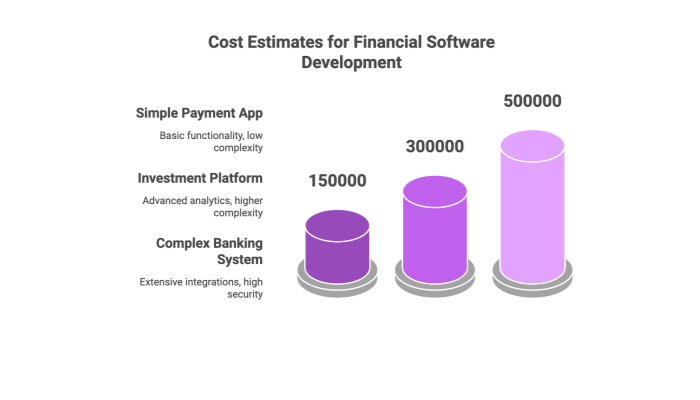

Cost estimates for financial software development vary widely based on project scope, complexity, team composition, and geographic factors. Key influences on cost include:

- Project Scope & Complexity: Advanced features like AI analytics or multi-currency support can significantly increase development time and costs.

- Team Composition: The number of specialists required—such as full-stack developers, QA engineers, and security experts—affects overall man-hour rates.

- Region & Vendor: Costs can vary based on the location of the development partner. Vendors in regions like India or Eastern Europe may offer competitive rates compared to those in Western Europe or North America.

Typical cost ranges include:

- Simple Payment/Money Transfer App: $10,000 – $150,000+

- Investment/Robo-Advisory Platform: $50,000 – $300,000+

- Complex Insurance or Banking System: $100,000 – $500,000+

ROI is gauged through increased revenue from improved user acquisition, operational savings from automation, and reduced risk of fraud through enhanced security.

Frequently Asked Questions

Below are answers to common questions regarding financial software development:

- What Is Financial Software Development? – It’s the process of creating custom or semi-custom fintech solutions to streamline banking, trading, insurance, payments, and other financial operations.

- How to Choose a Financial Software Development Company? – Focus on a vendor’s fintech track record, security methodology, agile proficiency, and client testimonials, ensuring they align with your technical and business needs.

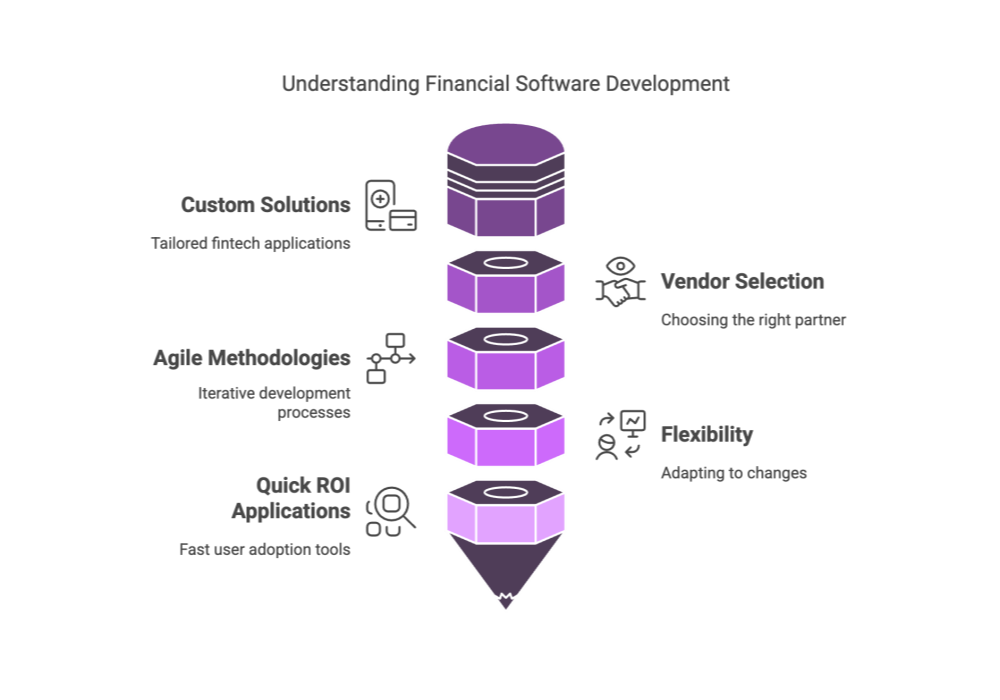

- What Are the Main Advantages of Using Agile Methodologies in Fintech? – Agile enables iterative development, constant user feedback, and rapid adaptation to regulatory changes, which are crucial for delivering secure and efficient financial solutions.

- How Does Agile Enhance Flexibility in Financial Software Development? – Agile frameworks like Scrum and Kanban allow teams to quickly adjust priorities and incorporate new requirements, avoiding costly rework and ensuring timely releases.

- Which Fintech Applications Yield Quick ROI? – Payment platforms, budgeting tools, and neobank apps often see fast user adoption, particularly when they address immediate pain points in financial management.

Conclusion

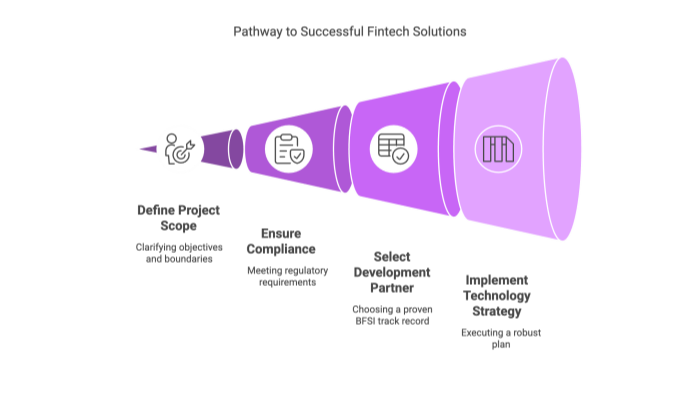

Financial software development offers a pathway to crafting secure, user-centric fintech products in a competitive global market. From building a streamlined crypto wallet to deploying enterprise-scale banking solutions, an agile, well-planned approach is essential to satisfy both end users and compliance authorities.

Before launching your project, clarify scope, confirm compliance protocols, and choose a financial software development company with proven BFSI expertise. With the right partner and a robust technology strategy, your fintech solution can drive revenue growth, enhance customer loyalty, and consistently adapt to the dynamic financial ecosystem of 2025 and beyond.

Get in Touch With Us

At Cognativ, we specialize in building custom financial software solutions that enhance security, streamline transactions, and drive revenue growth. Our team of experts is dedicated to understanding your unique challenges and crafting a solution that meets the demands of today's dynamic fintech landscape.

If you’re ready to explore how a tailored fintech solution can transform your business operations and deliver long-term value, contact us today. Let’s work together to build secure, scalable, and innovative financial applications that position your company for success in the future.