AI Co-pilots for Holiday Shopping: 2025 is a Turning Point for Retailers

This holiday season is the first where AI is not just a novelty widget on the website – it is sitting between customers and products as gift-finders, chat assistants and “shopping copilots.” Surveys show that almost every large US retailer plans to lean on AI for personalisation, pricing and service during peak season, while some are already building experiences optimised for AI discovery rather than human browsing.

The opportunity is huge, but so are the risks: hallucinated recommendations, broken journeys under peak load, and AI that optimises for clicks instead of trust. Retailers that treat this as a structured transformation rather than a quick experiment will come out of Q4 with a durable advantage, not just a seasonal gimmick.

Key takeaways

Retailers need a clear strategy for how AI supports customers across the entire journey, not just as a chatbot tucked in the corner of the site. The leaders are already connecting AI assistants to real-time inventory, pricing and logistics so that recommendations are accurate, shippable and profitable. Those who rush in without solid data and architecture will feel the downside first in customer support – and then in their P&L.

-

Nearly all large retailers surveyed (around 97%) plan to use AI this holiday season for personalisation, chatbots, inventory and pricing optimisation.

-

AI-powered gift-finders and assistants are becoming a primary entry point to product discovery, both on retailers’ own sites and inside third-party tools like ChatGPT and Gemini.

-

The competitive battle is shifting from “who has the biggest ad budget” to “who has the best AI-ready data, infrastructure and product content.”

-

To sustain results beyond the holidays, retailers need robust ecommerce platforms, modern data solutions and a clear AI-first roadmap – not just seasonal pilots.

Holiday 2025: the first AI-native shopping season

This year’s peak season is different because AI is present at every layer of the stack: front-end search, conversational assistance, logistics optimisation and risk management. For many shoppers, the “storefront” is no longer a homepage – it is a chat box that asks, “Who are you buying for?” and then curates the catalogue around that context.

From a market perspective, research shows that almost all large US retailers plan to use AI in some form to improve holiday experiences, from dynamic pricing to AI-powered customer service. At the same time, retailers are experimenting with new ways to be “visible” to external AI assistants, much like they once optimised for search engines.

If you want a deeper macro view on why this matters, Cognativ’s own analysis of the AI shopping boom explores how AI is already reshaping digital retail beyond a single season through evolving consumer behaviour and data expectations.

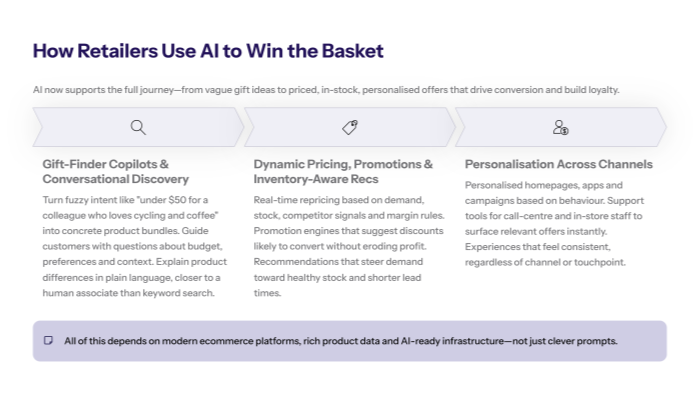

How retailers are using AI to win the basket

AI in holiday shopping is no longer just about recommending “similar products.” It spans the entire journey from idea to doorstep, and retailers are layering several use cases on top of each other.

Gift-finder copilots and conversational discovery

AI gift-finders help customers articulate vague intents like “something under $50 for a colleague who loves cycling and coffee” and then translate that into specific product bundles. These copilots can:

-

Guide customers through questions, narrowing down category, budget and preferences.

-

Explain product differences in clear language, particularly in complex categories like electronics or beauty.

-

Keep context across multiple queries, functioning closer to a human store associate than a keyword search box.

Retailers building this kind of experience usually need a more advanced ecommerce stack than basic off-the-shelf search. That is where structured solutions such as modern ecommerce software development and top retail software development solutions become critical, ensuring catalogues, attributes and content are rich enough for AI to reason over them.

Dynamic pricing, promotions and inventory-aware recommendations

Behind the scenes, AI is optimising what gets shown, at what price and when. Typical capabilities include:

-

Real-time repricing based on demand, stock, competitor signals and margin rules.

-

Promotion recommendation engines that suggest discounts likely to convert without eroding profitability.

-

Inventory-aware recommendations that steer demand towards products with healthier stock or shorter lead times.

Without a solid foundation in data engineering and AI-ready infrastructure, these systems can easily fragment across departments. That is why retailers increasingly move toward dedicated AI infrastructure and data solutions that centralise signals from ecommerce, logistics and marketing in a way AI models can reliably consume.

Personalisation across channels

Customers do not think in “channels” – they simply expect experiences to feel consistent. AI now powers:

-

Personalised homepages and app surfaces based on historical behaviour.

-

Tailored email and push campaigns generated in near real time.

-

Call-centre and in-store associate tools that surface relevant offers for each interaction.

Getting this right requires more than clever prompts. It needs coherent data models, a clear understanding of consent and identity, and ecommerce architectures designed for continuous experimentation. Guidance on ecommerce development and best ecommerce services can be particularly useful here for teams still modernising their stack.

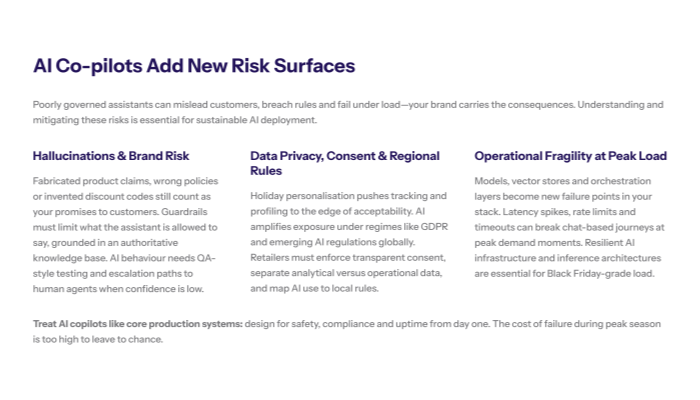

Risks retailers cannot ignore

The speed of AI rollout this year is impressive – but the risk surface is expanding just as quickly. Treating AI copilots as harmless “helpers” underestimates their power to shape purchasing behaviour and brand perception.

Hallucinations, brand risk and compliance

If an AI assistant fabricates product claims, misstates return policies or invents discount codes, the retailer owns the consequences. Customers will not excuse hallucinations just because “the AI said it.”

Retailers therefore need:

-

Guardrails on what the assistant is allowed to say, grounded in an authoritative knowledge base.

-

Clear escalation flows to human agents when confidence is low.

-

Testing regimes similar to software QA, but focused on AI behaviour and content safety.

Thoughtful AI observability and governance practices make a real difference here, helping teams catch failure patterns early and measure AI performance against business KPIs rather than vanity metrics.

Data privacy, consent and regional rules

Holiday campaigns tend to push personalisation to the edge: behavioural tracking, cross-device identity stitching, and aggressive remarketing. Adding AI into this mix amplifies regulatory exposure, especially in regions with strict privacy regimes.

Retailers should:

-

Maintain transparent consent and preference management, especially for AI-driven profiling.

-

Separate “analytical” and “operational” data to limit unnecessary exposure.

-

Map AI use cases to emerging regulations around automated decision-making and explainability.

If your retail organisation operates in multiple geographies, a clear AI strategy that aligns legal, data and engineering teams is no longer optional – it is a prerequisite for scaling AI beyond a few pilots.

Operational fragility at peak load

AI models add new points of failure: model hosts, vector databases, feature stores, prompt orchestration layers and more. Under peak seasonal load, these systems must scale as reliably as payment gateways or inventory APIs.

Typical issues include:

-

Latency spikes that make chat-based journeys feel sluggish.

-

Rate limits or capacity constraints from third-party AI providers.

-

Model timeouts causing blank or fallback responses at the worst possible moment.

This is precisely where robust AI infrastructure and inference architectures matter – not just for long-term innovation, but for surviving Black Friday without degraded performance.

Building the AI backbone for peak season and beyond

The retailers that will still be happy with their AI investments in Q2 next year are the ones treating this season as a proving ground for long-term capabilities, not just a one-off campaign.

Data and infrastructure foundations

Effective AI shopping experiences depend on high-quality, well-structured data: product information, customer behaviour, supply chain signals and content. Many organisations discover during holiday readiness that their existing systems were built for static sites, not AI-native personalisation.

Key priorities often include:

-

Cleaning and enriching product catalogues so attributes are machine-readable and consistent.

-

Implementing data pipelines that keep stock, price and content fresh in near real time.

-

Designing infrastructure specifically optimised for AI workloads – from embedding search to recommendation models.

For teams still at the start of this journey, it can be helpful to work with a partner that specialises in best practices for AI infrastructure and modern data architectures, rather than trying to retrofit legacy systems at the last minute.

Choosing an AI-first architecture

Retailers have several options for how to embed AI into their stack:

-

Thin integration of third-party AI assistants with minimal backend changes.

-

Bespoke AI components woven into existing ecommerce platforms.

-

Fully AI-first architectures where product discovery, merchandising and content are designed with AI from the ground up.

Each path has trade-offs in control, speed and cost. Strategic guidance on AI services and AI-first architecture can keep experimentation aligned with long-term goals, ensuring that what you build for holiday 2025 still adds value in 2026 and beyond.

What this means for retail strategy in 2026

Once customers get used to natural-language gift-finders and truly personalised journeys, they will not want to go back to static catalogues and generic promotions. That means the bar for “acceptable” digital retail experiences will quietly rise after this season – and the gap between AI leaders and laggards will widen.

For leadership teams, the question is no longer whether to use AI in holiday shopping, but how to embed it into the core of ecommerce strategy: platform choices, data investments, organisational design and vendor selection. Retailers that approach this systematically will be able to scale from one successful holiday campaign into a durable AI advantage across the entire year.

Where to go from here

If you are planning how AI will shape your next holiday season – or how to stabilise the pilots you already launched – this is a good moment to take stock of your architecture, data readiness and product roadmap.

To dive deeper and plan concrete next steps, you can:

-

Explore how AI is reshaping seasonal demand, infrastructure and consumer behaviour in our broader AI and ecommerce insights on the Cognativ

blog

.

-

Assess whether your current ecommerce platform can support AI-native experiences by reviewing guidance on retail and ecommerce software development, as well as practical advice on building effective AI infrastructure and data solutions.

-

Talk with a partner experienced in

AI services

,

ecommerce at scale

and

retail industry solutions

to design an AI-first roadmap that makes sense for your business, not just for this year’s peak shopping window.