Tech Giants Flood Bond Markets for AI Cloud Expansion Plans

In late 2025, the AI race stopped being funded mainly from the cash piles of Silicon Valley. Amazon, Microsoft, Alphabet, Meta and Oracle are now tapping bond markets at record scale to finance data centres, GPUs and cloud infrastructure for AI workloads. In just a few months, these firms have issued tens of billions of dollars in new investment-grade debt, with more still in the pipeline. Investors are buying, but their unease is growing as AI spending accelerates faster than clear proof of long-term returns.

This shift is more than a financing detail. It changes how AI risk is distributed across corporate balance sheets, credit portfolios and, ultimately, pension funds and sovereign investors that hold this paper. For enterprise leaders, the lesson is clear: AI strategy now lives inside capital structure decisions, not just on technology roadmaps.

Key takeaways

- Major US tech companies have raised close to 90–100 billion dollars in new bonds over recent months to fund AI-ready data centres and cloud expansion, outstripping their combined issuance over the prior several years.

- Analysts expect AI-related bond sales could reach 1.5 trillion dollars over the next five years and exceed 20 percent of the US investment-grade market by 2030, raising questions about concentration and valuation risk.

- For enterprises beyond Big Tech, the funding model matters: it shapes cloud pricing, vendor risk and the economics of building or buying AI infrastructure. Disciplined capital allocation and robust AI architecture design are now strategic necessities.

Why tech giants are turning to bond markets for AI?

The most striking feature of the current AI cycle is its capital intensity. Training and serving large models at scale require enormous spending on GPUs, accelerators, data-centre campuses, high-voltage power and fibre. Internal cash flows, while still strong, are no longer the only source of funding.

According to multiple reports, Amazon, Microsoft, Google-parent Alphabet, Meta and Oracle have collectively issued around 88–100 billion dollars of new investment-grade bonds over roughly a three-month window. This includes multi-tranche dollar deals, euro-denominated offerings and hybrid structures, all explicitly linked to AI and cloud expansion.

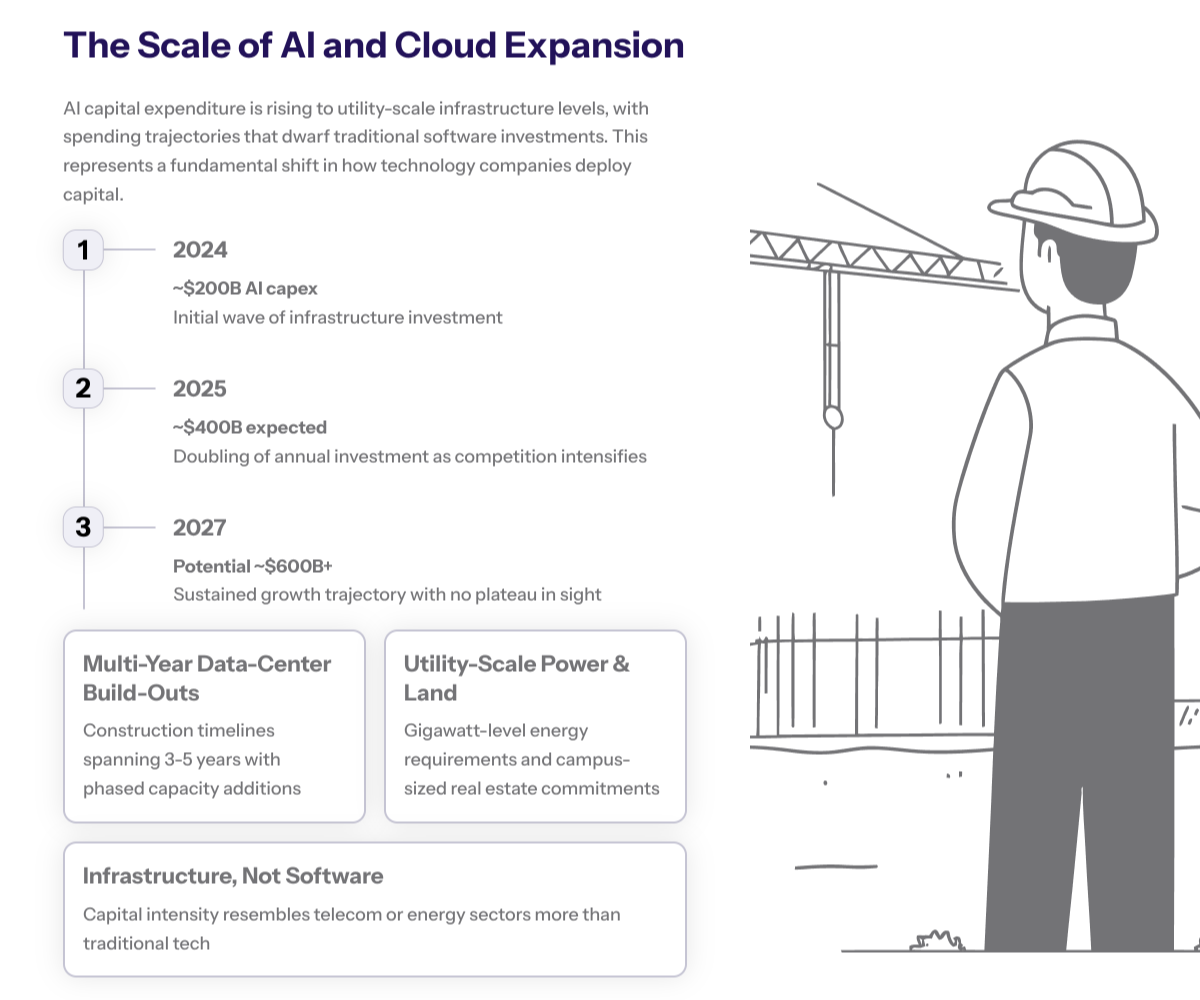

Forecasts suggest this is the opening phase rather than the peak. AI-related capital expenditure is projected to climb from roughly 200 billion dollars in 2024 to about 400 billion in 2025, and potentially 600 billion by 2027. Debt issuance is expected to rise alongside, with one investment manager estimating net issuance could reach 100 billion dollars in 2026 alone.

From cash-rich balance sheets to leveraged AI infrastructure

Historically, Big Tech was known for net cash positions and limited reliance on long-term debt. That posture is changing. Companies still hold substantial cash and short-term investments, but they now see cheap, long-dated borrowing as a way to accelerate AI infrastructure while preserving flexibility for buybacks, acquisitions and dividends.

The logic is straightforward:

- Rates, while higher than the zero-interest era, remain attractive for investment-grade issuers with strong ratings.

- Locking in funding now reduces exposure to future credit market volatility.

- Spreading costs over 10–40 year maturities matches the long-term strategic nature of AI and cloud platforms, at least on paper.

At the same time, this introduces a structural shift. More of the AI infrastructure stack is now funded by bondholders rather than purely by retained earnings. That means AI execution risk is increasingly shared with institutional investors, not just shareholders.

Cognativ’s own analysis in its piece on tech’s trillion-dollar AI commitments, “Tech’s trillion-dollar bet on AI” , highlighted how quickly capital requirements are scaling. The bond wave is the financing counterpart to that strategic bet.

The scale of planned AI and cloud expansion

Market estimates vary, but several themes are consistent across research from banks and asset managers:

- Aggregate AI and cloud capex by the largest US tech firms is expected to approach or exceed 400 billion dollars in 2025 and keep rising thereafter.

- Deutsche Bank and J.P. Morgan analysts suggest that, globally, AI-related investment could reach several trillion dollars by 2030, with a substantial share routed through listed bond markets.

- AI data-centre projects are often structured as multi-year build-outs, requiring commitments to land, power and chips that last well beyond a single product cycle.

This is why AI is increasingly being described as a “utility-scale” infrastructure build rather than a typical software upgrade. The construction and energy profile looks closer to telecom or power generation than to classic internet services, a point that Cognativ has explored through its coverage of AI infrastructure building effective modern data solutions .

Inside the AI bond wave issuers, structures and pricing

While headlines talk about “Big Tech” as a bloc, the funding strategies and risk profiles differ meaningfully across companies.

Alphabet, Meta and Oracle have been among the more aggressive issuers, with Meta reportedly undertaking one of the largest bond offerings in its history and Oracle looking to sell tens of billions in new debt to finance AI infrastructure. Amazon and Microsoft, meanwhile, have also issued sizable deals but remain cushioned by larger cash reserves and diversified revenue.

Who is issuing and how much?

Recent data from Dealogic and other providers, summarised in public reporting, paint a clear picture:

- Over a recent three-month period, the “big five” AI spenders issued roughly 88 billion dollars in new investment-grade bonds.

- AI-linked issuance in 2025 has already surpassed the combined total of their bond sales from the prior several years.

- The four largest US cloud and AI companies have together raised more than 120 billion dollars this year when adding some private and hybrid structures.

Maturities range widely, from shorter 5- and 7-year tranches to 30- and 40-year bonds, reflecting a deliberate attempt to spread refinancing risk. Coupons remain below historic averages for similar tenors, but spreads have started to widen modestly as investor caution grows.

Deal structure, maturities and emerging pricing trends

Several structural features stand out in these AI-driven bond deals:

- Multi-tranche deals allow issuers to calibrate demand across investor bases, from insurance firms chasing long-dated paper to funds seeking more liquid 10-year issues.

- Some bonds come with use-of-proceeds language referencing data-centre build-outs, AI infrastructure or cloud platforms, signalling the strategic purpose of the funds.

- Pricing has evolved: early AI deals priced very tightly, but recent offerings have required slightly higher yields and concessions to clear the market, especially for issuers seen as carrying more execution risk on AI.

This is where credit differentiation begins to matter. Credit analysts have already flagged Oracle as a comparatively weaker link among hyperscalers, citing rising liabilities and data-centre lease commitments. Its bonds and credit default swaps have attracted outsized attention from traders looking to express views on AI debt risk.

Investor jitters and credit market implications

Despite strong demand for AI bonds so far, investors and regulators are vocal about the longer-term risks. The US corporate bond market is around 9 trillion dollars in size. If AI-related issuance reaches the projected 1.5 trillion dollars over five years and grows toward one-fifth of the investment-grade universe by 2030, thematic concentration becomes hard to ignore.

Prominent asset managers such as DoubleLine Capital have publicly warned that the AI funding wave could reshape the structure and risk profile of high-grade debt. In their view, the chief issue is not immediate default risk, but the combination of long-dated obligations with assets and technologies that may become obsolete much faster.

Concerns over market strain and valuation disconnects

Several themes recur in recent financial-stability commentary:

- Stretch in valuations: central banks like the ECB note that FOMO around AI is driving “stretched” US tech valuations, with limited room for error if AI adoption slows or margins compress.

- Circular exposure: equity investors, bondholders and derivative markets are increasingly tied to the same small group of AI leaders, amplifying any future shock to their earnings or capex plans.

- Liquidity questions: a heavy skew toward long-dated corporate bonds could test secondary-market liquidity in a risk-off episode, particularly if many investors try to de-risk at once.

From a policy standpoint, there is also growing interest in how corporate AI capex interacts with sovereign debt markets, term premia and the cost of capital more broadly. Cognativ has examined this channel in depth in its coverage of corporate AI capex and US Treasuries , arguing that AI funding choices are beginning to matter for macro-level rates as well as firm-level risk.

Strong versus weak credits in the AI race

Not all AI debt is created equal. Larger platforms with diversified revenue, deep cash buffers and strong ratings are better placed to carry higher leverage. For them, the main risk is overpaying for capacity that is underutilised if AI demand falls short.

For more marginal players, including some speculative-grade data-centre developers and cloud challengers, the risk is sharper. They face:

- higher funding costs and more cyclical investor appetite

- operational delays that can quickly erode liquidity

- competitive pressure from hyperscalers that can undercut pricing

Reports on companies such as CoreWeave and smaller miners highlight how quickly yields can move toward distressed territory when execution wobbles, even though the flagship AI names remain comfortably investment-grade.

For CIOs and CFOs in other sectors, this segmentation is instructive. AI investments need to be sized and funded in a way that matches the true resilience of the underlying business, rather than mirroring the playbook of trillion-dollar platforms.

Strategic lessons for enterprises beyond Big Tech

Although most enterprises will not tap bond markets at the scale of Amazon or Microsoft, the underlying discipline applies across the board. AI projects, whether built in-house or through cloud services, sit at the intersection of technology, finance and risk.

Executives should avoid framing AI as a special category of spending that bypasses normal capital-allocation rules. Instead, AI infrastructure and applications should be evaluated with the same rigor as any large transformation initiative, linking model choices, data pipelines and architecture to measurable business outcomes. Cognativ’s work on AI infrastructure solutions and use cases and its broader AI services highlights how architecture decisions translate directly into cost, scalability and risk.

Aligning AI ambition with capital structure

A practical playbook for boards and CFOs might include:

- mapping AI initiatives into tiers (core, adjacent, exploratory) with tailored funding expectations for each

- matching funding tenor to asset life and vendor commitments, avoiding long-dated obligations for short-lived experiments

- stress-testing AI projects against scenarios where adoption is slower, regulation is tighter or input costs (such as power or GPUs) rise

- ensuring that AI-driven contracts with cloud providers and model vendors are transparent about pricing, exit options and performance guarantees

Enterprises without in-house experience in these areas can benefit from specialist partners who combine technical and financial perspectives. Cognativ’s AI-first architecture services are designed to help organisations build AI systems that are efficient at both the engineering and balance-sheet level.

Designing AI infrastructure with financial prudence

Many of the risks that worry bond investors are rooted in infrastructure design choices. For example:

- Over-provisioned GPU clusters that sit idle because workloads were overestimated.

- Architectures tightly coupled to a single vendor, limiting negotiation power and migration flexibility.

- Data-centre investments that do not account for power-pricing volatility or grid constraints.

By contrast, architectures built around modular, portable workloads, observability and clear utilisation metrics can reduce the need for over-investment. Cognativ’s guidance on best practices for building AI infrastructure emphasises interoperability, efficient resource scheduling and realistic capacity planning as ways to keep both technical and financial risk in check.

For sectors such as banking, energy, manufacturing or logistics, where AI is becoming embedded in mission-critical operations, the goal is not to replicate hyperscaler scale, but to adopt their discipline in monitoring utilisation, risk and return.

Conclusion

The current wave of bond issuance by US tech giants marks a turning point in how the AI boom is financed. Record volumes of investment-grade debt are being deployed into data centres, chips and cloud platforms, with investors eager to participate but increasingly attentive to concentration and execution risk. If AI delivers on its most optimistic projections, these bonds will look like well-priced exposure to a generational technology shift. If it falls short, the adjustment will reverberate across credit markets, not only equities.

For enterprises outside the hyperscaler tier, the lesson is not to avoid AI but to fund it intelligently. AI projects should sit within a coherent capital strategy, anchored in realistic utilisation, modular infrastructure and clear value hypotheses. The firms that treat AI as part of an integrated business and financing plan, rather than as a standalone technology race, will be better positioned to thrive in whatever market regime follows this initial debt-fuelled expansion.

If your organisation is reassessing its AI roadmap, cloud strategy or capital plan, explore how Cognativ’s AI-first architecture and broader AI services can help align technology, infrastructure and funding decisions.

To stay ahead of how AI, markets and infrastructure intersect, follow What Goes On, Cognativ’s weekly tech digest, via the Cognativ AI and software insights blog for ongoing, executive-level analysis.