OpenAI's Ambition: Can $13 Billion in Annual Revenue Fuel the AI Revolution?

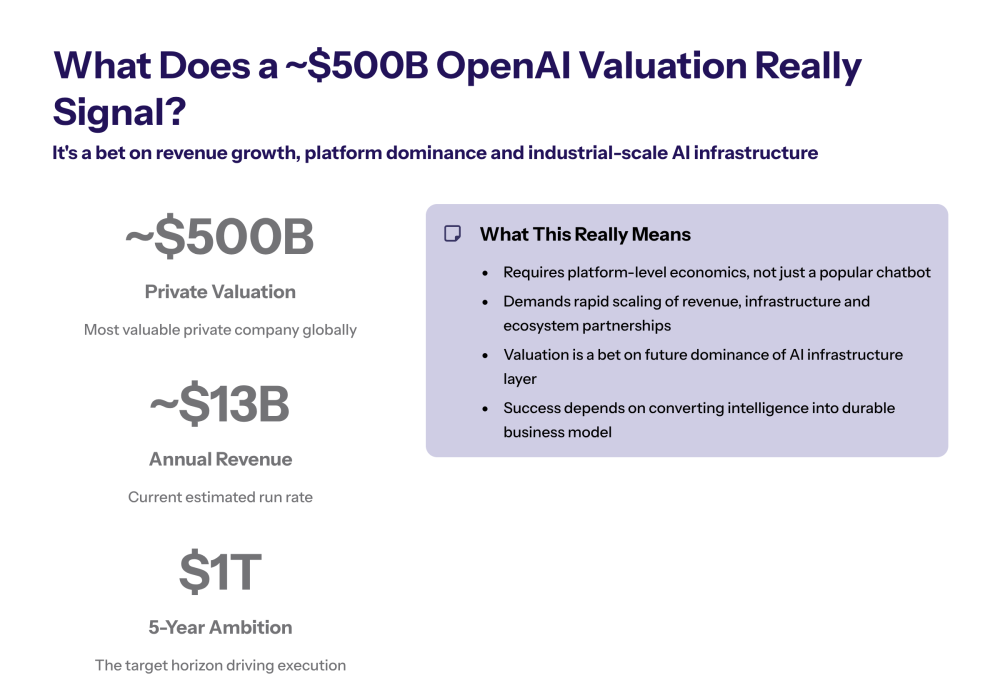

The race toward trillion-dollar valuations isn’t just about ambition — it’s about execution. OpenAI, a startup now valued among the world's most ambitious tech companies, currently generates an estimated billions of dollars annually, primarily from its flagship product ChatGPT. As the ChatGPT maker, OpenAI faces a monumental challenge: turning that strong revenue base into the foundation of a $1 trillion valuation in just five years. This goal isn’t just aggressive — it would make OpenAI one of the fastest companies in history to reach this scale.

Unlike the social media boom of the 2010s, the AI economy is deeply tied to infrastructure, energy, and regulation. The billions of dollars involved in private market investments and funding rounds have played a crucial role in OpenAI's current valuation. That means the path to hypergrowth won’t rely only on more users — but on redefining how intelligence is monetized, deployed, and scaled globally.

Key Takeaways

-

OpenAI's $13 billion in annual revenue is substantial but not sufficient alone to justify a $1 trillion valuation without expanding its AI ecosystem and platformization.

-

The ambitious five-year timeline reflects investor expectations tied to OpenAI’s ability to scale AI systems and infrastructure rapidly.

-

Scaling compute infrastructure, including securing GPU supply chains and optimizing accounting for operational costs, is critical for sustaining growth.

-

Competition from Anthropic, Google DeepMind, and open-source AI projects will influence OpenAI's market share and valuation trajectory.

-

Strategic expansion into the AI agent economy and enterprise AI tools can attract more capital and increase shareholder value.

-

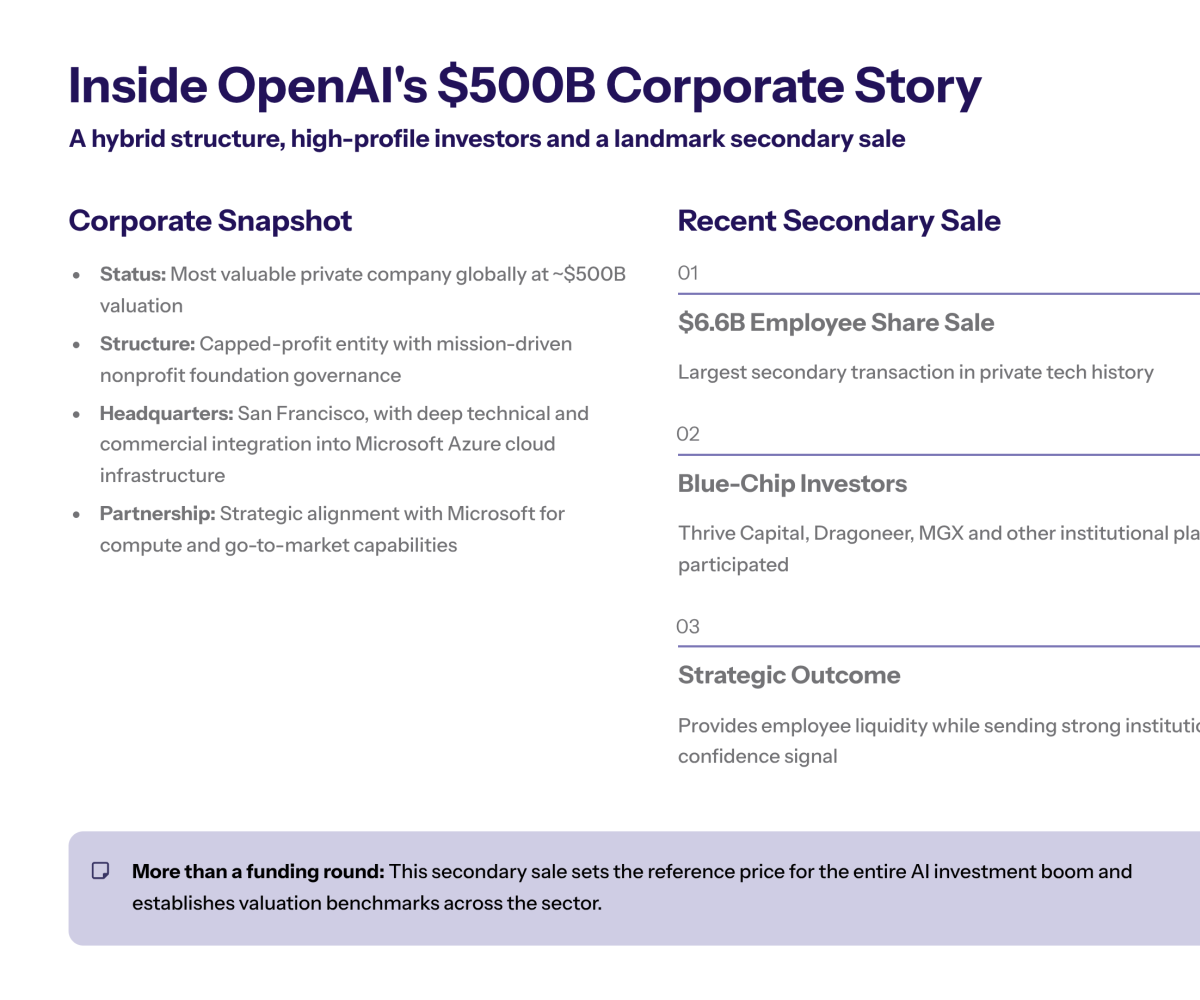

Recent secondary share sales involving investors like Thrive Capital, Dragoneer Investment Group, and Rowe Price highlight strong confidence in OpenAI’s for-profit structure and future prospects.

-

Leadership under OpenAI CEO Sam Altman remains a key factor in driving innovation, securing partnerships, and navigating the evolving AI boom.

Corporate Overview

OpenAI has rapidly ascended to become the world’s most valuable private company, recently achieving a staggering $500 billion valuation in the private market. This milestone was reached through a landmark secondary share sale, where current and former employees sold approximately $6.6 billion in stock to a select group of high-profile investors, including Thrive Capital, Dragoneer Investment Group, and Abu Dhabi’s MGX. The transaction not only provided liquidity for employees but also signaled strong institutional confidence in OpenAI’s future as a for-profit company at the forefront of the AI boom.

Under the visionary leadership of CEO Sam Altman, OpenAI has redefined what’s possible in the artificial intelligence space. The company’s innovative corporate structure—combining a for-profit entity with a mission-driven approach—has enabled it to access more capital for ambitious AI research and development. This structure has proven instrumental in attracting investments from major institutions and strategic partners, most notably Microsoft, which has played a pivotal role in supporting OpenAI’s infrastructure and growth.

OpenAI’s success is closely tied to its ability to develop and deploy advanced AI systems, such as large language models and cutting-edge AI tools that have captured the world’s attention. The company’s headquarters in San Francisco positions it at the heart of the global technology ecosystem, allowing it to recruit top-tier talent and stay ahead in the rapidly evolving AI space.

The recent employee share sale not only rewarded early contributors but also injected significant cash into the company, reinforcing its ability to scale research, development, and deployment of transformative AI technologies. As reported by The Wall Street Journal, Yahoo Finance, and Vanity Fair, OpenAI’s $500 billion valuation now surpasses that of Elon Musk’s SpaceX, underscoring its status as a valuable private company and a magnet for both capital and talent.

With a robust foundation, a dynamic leadership team, and a clear strategy for growth, OpenAI is well-positioned to continue shaping the future of artificial intelligence. Its ability to attract major investments, execute large-scale secondary share sales, and maintain a strong corporate structure has set a new benchmark in the private market. As interest from global investors and companies intensifies, OpenAI’s trajectory is a sign of the transformative potential—and high stakes—of the AI revolution.

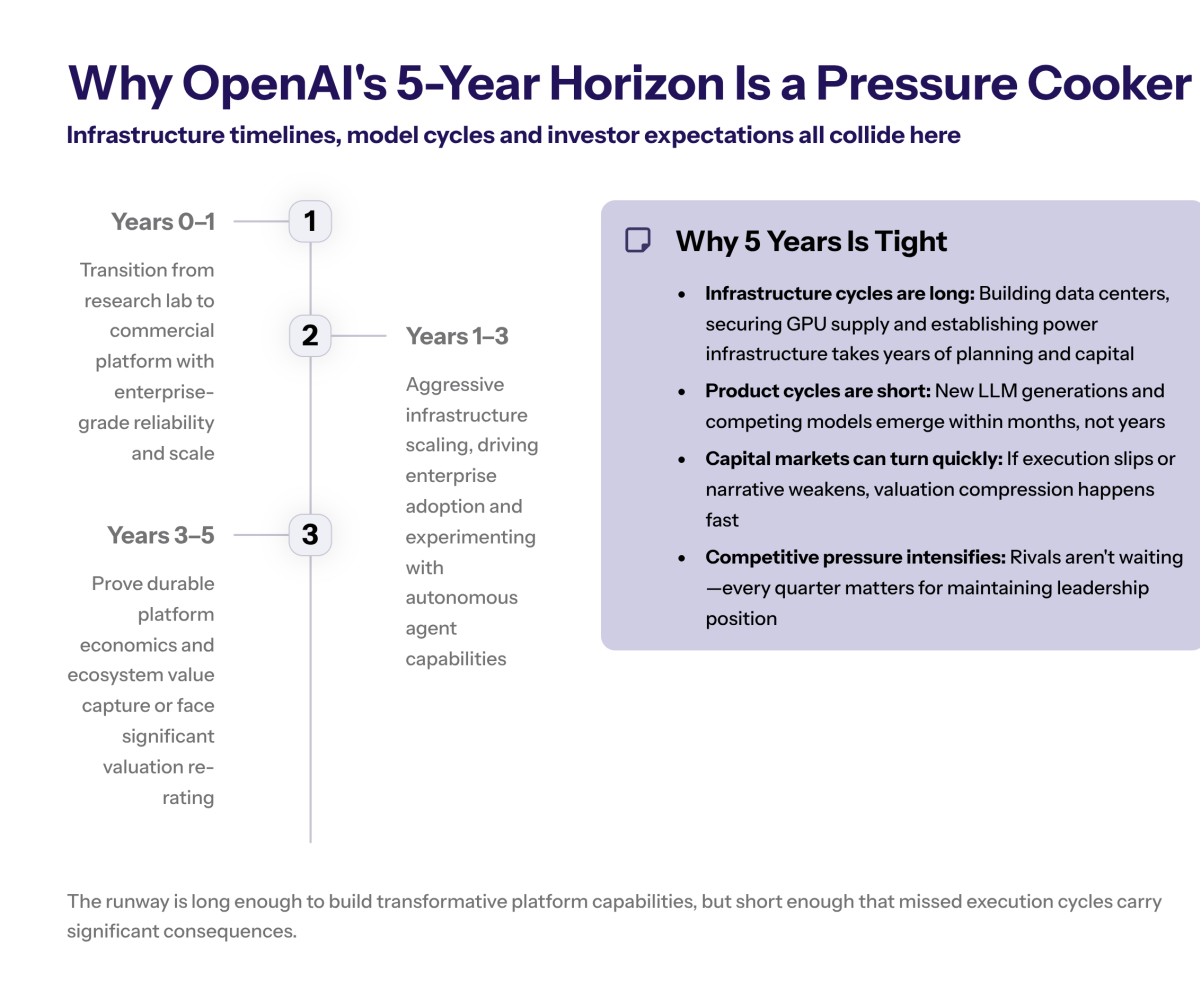

A Bold Timeline — Why 5 Years Matter

The five-year window is more than a financial target — it’s a strategic pressure cooker. Investors have tied OpenAI’s valuation narrative to its ability to scale both revenue and infrastructure at an unprecedented pace. Five years is short in infrastructure terms but long enough to build a platform economy if executed correctly.

The Pressure Behind the Clock

The clock started ticking when OpenAI moved from being a research lab to a commercial entity. Partnerships with Microsoft, mass adoption of ChatGPT, and explosive AI demand created a growth narrative investors now expect to materialize. This timeline is also influenced by the current AI arms race, where capital and market share consolidate quickly. Missing the moment would mean ceding ground to faster-moving players — both corporate and open-source.

Scaling Revenue vs. Scaling Reality

Revenue can grow linearly with subscriptions and API usage. But infrastructure — data centers, GPU clusters, energy supply — grows exponentially in cost and complexity. That’s why five years isn’t just a projection; it’s the margin of maneuver OpenAI has to transition from a single-product model to a multi-layered AI ecosystem.

The reality is stark: sustaining trillion-dollar expectations requires platform economics, not just clever monetization of a chatbot. And in this high-stakes race, every quarter counts.

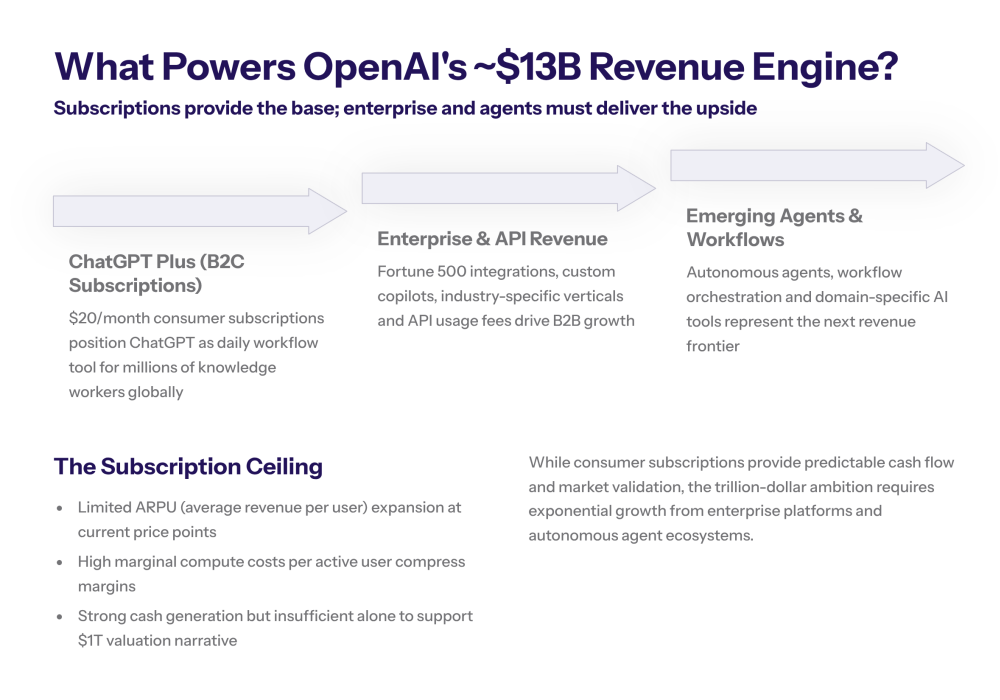

The $13 Billion Engine — Monetizing Intelligence

The $13 billion in annual revenue powering OpenAI isn’t an accident — it’s the result of a carefully structured monetization strategy built on accessibility, habit, and infrastructure. Unlike traditional SaaS products, OpenAI isn’t selling a tool. It’s selling access to intelligence — and that fundamentally changes the economics of scale.

The challenge now is evolving from strong subscription economics into a true platform model capable of supporting trillion-dollar valuations. This means moving from selling access to single users toward monetizing entire ecosystems. OpenAI's business strategy is increasingly focused on expanding its commercial activities, building partnerships with enterprise clients, and driving financial growth through diverse business collaborations.

The Subscription Core

The foundation of OpenAI’s revenue engine is ChatGPT Plus. At $20 per month, this tier unlocked premium access to faster responses, better models, and priority usage. It transformed AI from a novelty into a daily workflow tool for millions of users worldwide, much like the latest AI chatbot development services are enhancing customer engagement across businesses.

While impressive, subscription revenue has natural ceilings. Even with tens of millions of subscribers, the margins remain constrained by compute costs — primarily GPU infrastructure provided through partners like Microsoft and NVIDIA hardware.

This is why subscription alone can’t sustain OpenAI’s trillion-dollar vision. It’s a cash flow base, not a valuation driver.

Enterprise Deals and Platform Expansion

The second layer of OpenAI’s monetization engine lies in enterprise adoption. From Fortune 500 companies integrating GPT models into internal workflows to developers building their own copilots, these deals unlock significantly larger revenue per customer.

Partnerships — like the strategic alliance with Microsoft to embed GPT across productivity tools — are a glimpse of OpenAI’s platformization strategy. Instead of one-off usage, the company positions itself as a critical layer of corporate infrastructure, similar to what cloud computing became in the 2010s.

Looking ahead, expansion into AI agents, autonomous workflow orchestration, and domain-specific verticals (healthcare, legal, finance) will be key to lifting ARPU (average revenue per user) and turning linear revenue into exponential value. That shift — from product to platform — is the lever that could move OpenAI closer to its trillion-dollar ambition.

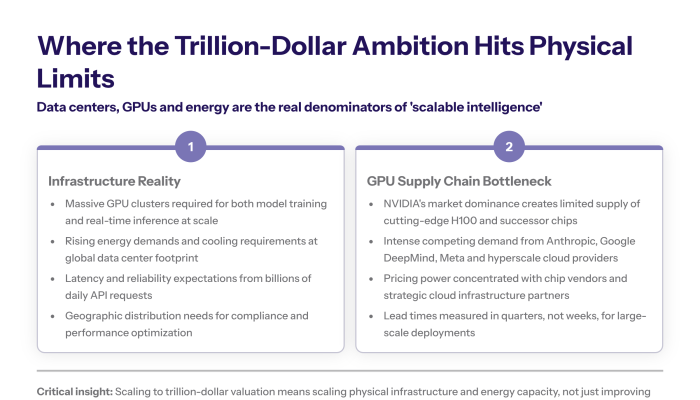

Infrastructure, GPUs, and the Cost of Scaling AI

The next phase of OpenAI’s growth isn’t just about acquiring users — it’s about sustaining the computational backbone required to serve them. Unlike typical software products, AI runs on compute-heavy infrastructure that scales exponentially with usage. That means revenue growth comes with a parallel cost curve that can’t be ignored.

This is where OpenAI’s trillion-dollar ambition hits its most critical constraint: the physical limits of infrastructure.

Why Scaling Intelligence Isn’t Cheap?

Every query made through ChatGPT travels through massive clusters of specialized hardware — mostly GPU-based systems optimized for AI inference. These aren’t one-time investments; they require continuous capacity expansion, energy consumption, and network reliability at global scale.

Unlike cloud-native SaaS models that rely on relatively stable marginal costs, AI models increase costs per interaction as adoption grows. This creates a tension between monetization and operational sustainability: for every new user, infrastructure cost must be justified by ARPU.

That’s why OpenAI’s partnerships with Microsoft’s Azure cloud are strategic, not optional. By leveraging hyperscaler infrastructure, OpenAI reduces upfront capital costs — but becomes deeply tied to a single critical supplier.

The GPU Supply Chain Bottleneck

Then comes the second constraint: hardware scarcity. The global demand for GPUs — particularly from NVIDIA — is outpacing supply. This creates pricing pressure and delays in scaling capacity. Competing players like Anthropic and Google DeepMind face the same bottleneck, turning hardware procurement into a competitive advantage.

To scale toward a trillion-dollar valuation, OpenAI must navigate this supply chain with precision. Whether that means developing proprietary hardware, securing exclusive contracts, or optimizing inference efficiency — the GPU layer is where valuation ambition collides with physical reality.

This is also why infrastructure strategy, not just user growth, will be the ultimate predictor of OpenAI’s long-term dominance. Scaling intelligence requires more than algorithms; it demands industrial-grade supply chains.

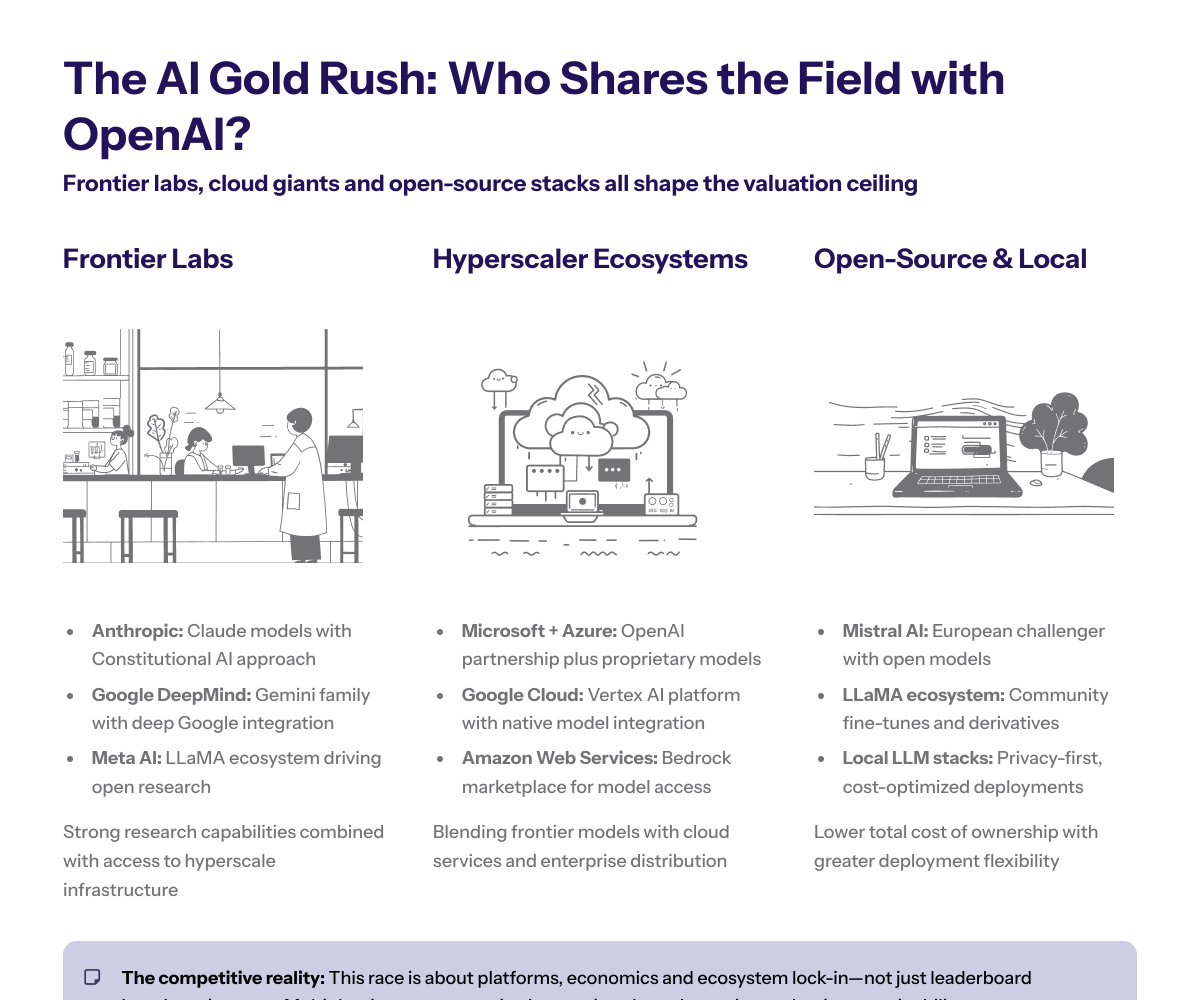

Competing in the AI Gold Rush

While OpenAI pushes toward its trillion-dollar horizon, the AI landscape is rapidly filling with heavyweight competitors, open-source disruptors, and well-capitalized challengers. As a leading AI organization, OpenAI is competing in a global gold rush where everyone is racing to stake their claim.

In this environment, OpenAI’s path to valuation supremacy will depend not only on what it builds but on how fast and efficiently it moves.

A Race Against Time and Capital

>The most visible competitors — Anthropic, Google DeepMind, and Meta — aren’t just building models. They’re building platforms, distribution networks, and developer ecosystems designed to secure long-term dominance.

>These companies already have massive infrastructure footprints and deep pockets, making speed a decisive factor. OpenAI’s competitive edge today lies in its early adoption curve and powerful user base through ChatGPT. But that edge narrows as competing solutions reach enterprise maturity.

>This isn’t a static market. AI platforms are evolving in months, not years. Missing a single product cycle can shift strategic positioning — which makes OpenAI’s five-year runway extremely tight.

Open Source vs. Proprietary Power Plays

One of the most disruptive forces in this race is the rise of open-source AI. From Mistral AI to community-driven initiatives around local models, open alternatives are driving cost down and innovation speed up.

While OpenAI operates with a proprietary model strategy, open ecosystems present a different value proposition: decentralized control and faster iteration. This is especially attractive to enterprises seeking flexibility and cost control — a segment OpenAI must protect if it wants to scale beyond subscriptions.

That means the battle isn’t just between companies. It’s between economic models: centralized proprietary power vs. distributed innovation. How OpenAI positions itself here — whether by embracing hybrid strategies or doubling down on platform lock-in — will determine its share of the trillion-dollar pie.

From Revenue to Ecosystem — The $1 Trillion Playbook

To transform $13 billion in annual revenue into a $1 trillion valuation, OpenAI must evolve beyond subscriptions and API calls. Securing additional fund(s) is crucial to support the development and expansion of the OpenAI ecosystem, enabling sustained growth and innovation. The real multiplier lies in ecosystem economics — building an environment where developers, enterprises, and end users create value on top of the platform.

This is the transition that turned cloud computing, mobile OSs, and social media platforms into trillion-dollar businesses. AI is next — and OpenAI knows it.

The AI Agent Economy

The emerging AI agent economy is more than a buzzword. It represents a shift from passive models to autonomous systems that can plan, execute, and adapt workflows on behalf of users. Instead of asking ChatGPT for an answer, users will deploy autonomous agents to handle complex processes across verticals like finance, legal, logistics, and healthcare.

For OpenAI, this means capturing new layers of value:

-

Platform fees on third-party agent marketplaces.

-

High-value enterprise subscriptions for agent orchestration.

-

Strategic partnerships with software ecosystems that plug directly into these agents.

This move effectively turns OpenAI from a product company into a foundational operating layer for AI-driven businesses.

Platformization and Value Capture

Trillion-dollar platforms don’t just sell services — they enable economies. Microsoft did it with cloud computing. Apple did it with mobile. OpenAI is poised to do it with intelligence.

By fostering a developer ecosystem around its models, APIs, and soon its agent frameworks, OpenAI can compound value creation through:

-

Ecosystem stickiness → lower churn, higher lifetime value.

-

Third-party innovation → faster product cycles without owning every vertical.

-

Network effects → more users drive more developers, driving more use cases.

This platformization strategy is how OpenAI can sustain a valuation narrative that goes far beyond chatbot subscriptions. It positions the company at the center of the AI economy, not just as a service provider but as the infrastructure powering intelligent workflows at global scale.

The Risk Side — Valuation ≠ Reality

Every trillion-dollar ambition carries a shadow: the risk of narrative collapse. For OpenAI, the story isn’t just about building world-class AI — it’s about maintaining investor trust, regulatory stability, and infrastructure resilience. A single weak link in that chain can derail even the strongest growth engine.

In other words, valuation targets are not guarantees. They’re bets on future execution.

Regulation, Geopolitics, and Market Fatigue

AI is no longer a niche technology; it’s a matter of national interest. Governments around the world are accelerating regulatory frameworks to control model deployment, data flows, and usage compliance. From the EU’s AI Act to U.S. federal discussions, OpenAI faces increasing scrutiny on transparency, safety, and data governance.

These pressures come with real costs — both operational and reputational. Regulatory compliance can slow product rollouts, restrict capabilities, or impose heavy reporting requirements that directly impact profitability.

Geopolitics adds another layer. Export controls on advanced chips, global supply chain tensions, and competing national AI programs mean OpenAI must navigate a highly politicized landscape while keeping its scaling timeline intact. And as markets mature, investor enthusiasm can cool if revenue doesn’t keep pace with expectations.

What Happens If the Narrative Breaks?

OpenAI’s valuation is built not just on current performance but on future belief — belief in its ability to dominate AI infrastructure, defend its market position, and build a self-sustaining ecosystem. If any of those pillars weakens, the valuation could compress rapidly.

Potential triggers include:

-

Delays or cost overruns in infrastructure expansion.

-

Stronger competition from open-source ecosystems.

-

Regulatory setbacks or forced transparency mandates.

-

Investor fatigue if growth metrics plateau.

For a company with this level of exposure, narrative is capital. And maintaining that narrative over a five-year sprint requires flawless execution, strategic agility, and sustained market confidence.

Final Thoughts — The Trillion Dollar Test

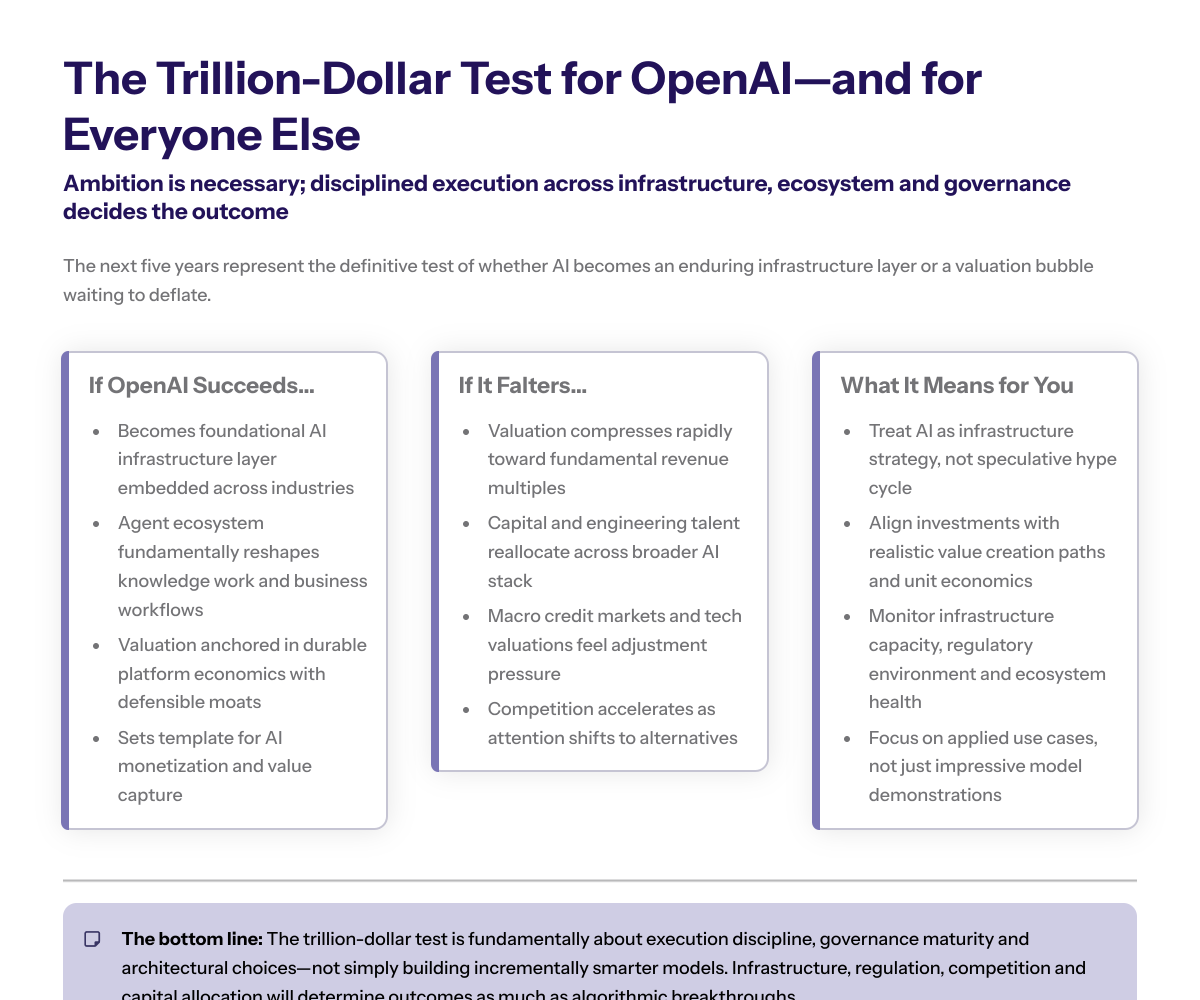

The next five years will determine whether OpenAI becomes the defining infrastructure company of the AI era — or just one of its biggest cautionary tales. Reaching a $1 trillion valuation isn’t about stacking revenue; it’s about engineering an entire ecosystem around intelligence.

OpenAI has a head start: strong subscription growth, enterprise adoption, and early leadership in the generative AI space. But leadership in this market is fragile. It depends on execution speed, infrastructure resilience, regulatory navigation, and the company’s ability to shape — not just follow — the AI economy.

If OpenAI succeeds in evolving from a model provider to a platform orchestrator, the outcome could mirror the trajectory of Microsoft in cloud or Apple in mobile. If it falters, the gap between valuation and reality could close fast — with ripple effects across the entire AI ecosystem.

For businesses, founders, and policymakers, this moment isn’t just about OpenAI. It’s about understanding the structural shifts AI will drive in the next half-decade — shifts that will shape how we work, build, and compete.

As AI technologies advance, significant changes in jobs and employment opportunities are expected, with both job creation and automation transforming the workforce, reflecting broader AI integration in the workplace. OpenAI's co-founders, including Sam Altman, have emphasized a vision for responsible AI development that aims to maximize benefits for society and guide the future of work.